Medicare vs Medicaid for Long Term Care Ohio Guide

Navigating the maze of senior care in Greater Cleveland is overwhelming. You're buried in glossy brochures, fielding calls from sales reps, and terrified of making a costly mistake. This guide is for you. We're here to be your trusted insider, translating the marketing fluff into reality so you can make a confident decision for your family.

Here’s the bottom line upfront:

-

Medicare is for short-term rehab. Think of it as a bridge from the hospital back home. It covers up to 100 days of skilled medical care after a qualifying hospital stay, but it was never designed for long-term living.

-

Medicaid is for long-term care. It's the financial safety net for ongoing support, whether in a nursing home or, for many, through Ohio's Assisted Living (AL) Waiver program.

-

The biggest mistake is assuming Medicare will pay for assisted living. It doesn't. This misunderstanding can lead to surprise bills in the tens of thousands of dollars.

-

Finding a community that accepts the AL Waiver is hard. Spots are limited and availability changes daily. Going it alone means wasting weeks on tours for communities that aren't a real option.

Your Guide to Medicare vs Medicaid in Ohio

For families across Cuyahoga, Lake, Lorain, and Medina counties, the senior care journey often starts with a crisis: a sudden fall, a hospital stay, and a doctor saying your loved one can't go home alone.

This moment, often happening within the walls of the Cleveland Clinic or University Hospitals, is when the critical question of "who pays?" hits. The answer is not simple, and the brochures won't tell you the whole truth. They'll show you the chandeliers, but we'll help you ask about the weekend staffing ratios. This is where the paths of Medicare and Medicaid diverge, and choosing the right one from the start is the key to a sustainable plan.

Understanding the Two Paths for Long Term Care

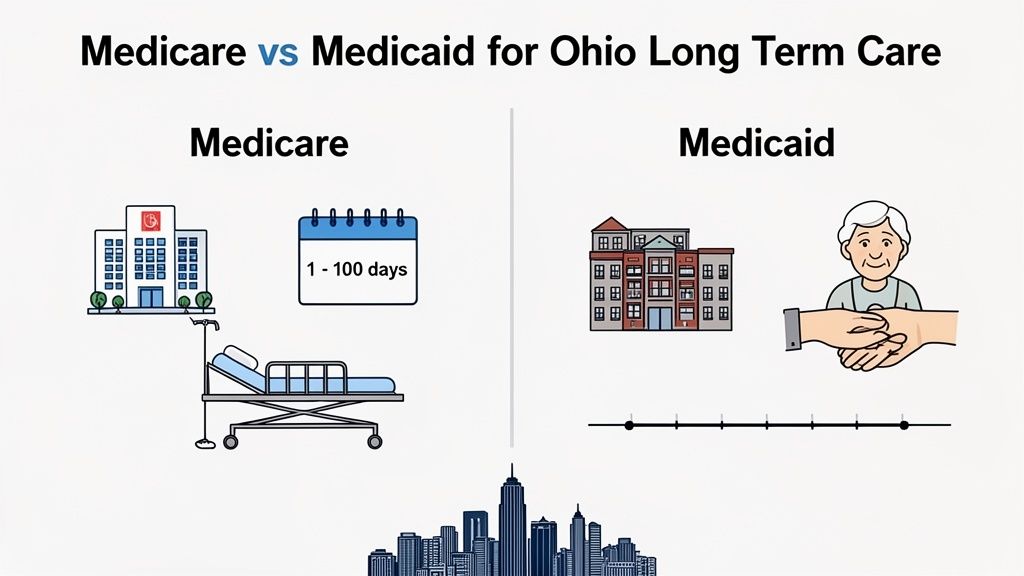

Medicare and Medicaid are not interchangeable. They serve completely different purposes.

-

Medicare is federal health insurance for those 65+ or with certain disabilities. Its goal is short-term medical recovery.

-

Medicaid is a joint federal and state program for people with limited income and assets. Its goal is to provide ongoing, long-term support.

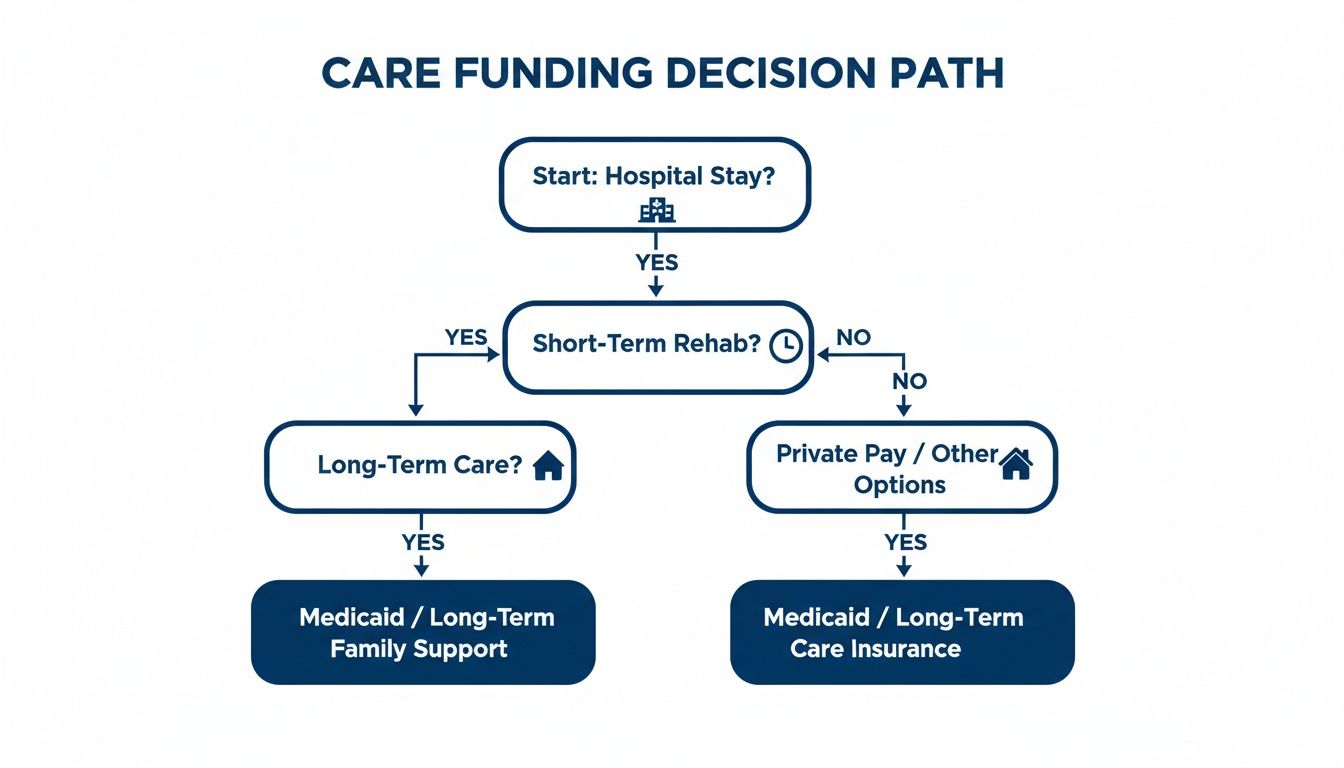

This flowchart shows how a hospital stay (often paid for by Medicare) can quickly transition into a need for long-term care, where Medicaid becomes the essential financial tool.

Medicare vs Medicaid Long Term Care Coverage at a Glance

Let's cut through the jargon. Here’s a side-by-side comparison for long-term care in Ohio.

| Coverage Aspect | Medicare in Ohio | Medicaid in Ohio |

| :--- | :--- | :--- |

| Primary Purpose | Short-term medical recovery after a 3-day inpatient hospital stay. | Long-term custodial and medical care for financially eligible individuals. |

| Assisted Living | Does not cover room and board or personal care. | Covers care services through programs like the Assisted Living (AL) Waiver. |

| Nursing Home Stay | Covers up to 100 days of skilled nursing with hefty copays after day 20. | Can cover ongoing, long-term stays for eligible residents. |

| Eligibility | Age (65+) or disability, regardless of income. | Based on strict income and asset limits set by the State of Ohio. |

In short, Medicare helps you heal. Medicaid helps you live safely when you can no longer be independent.

What Medicare Actually Covers for Senior Care

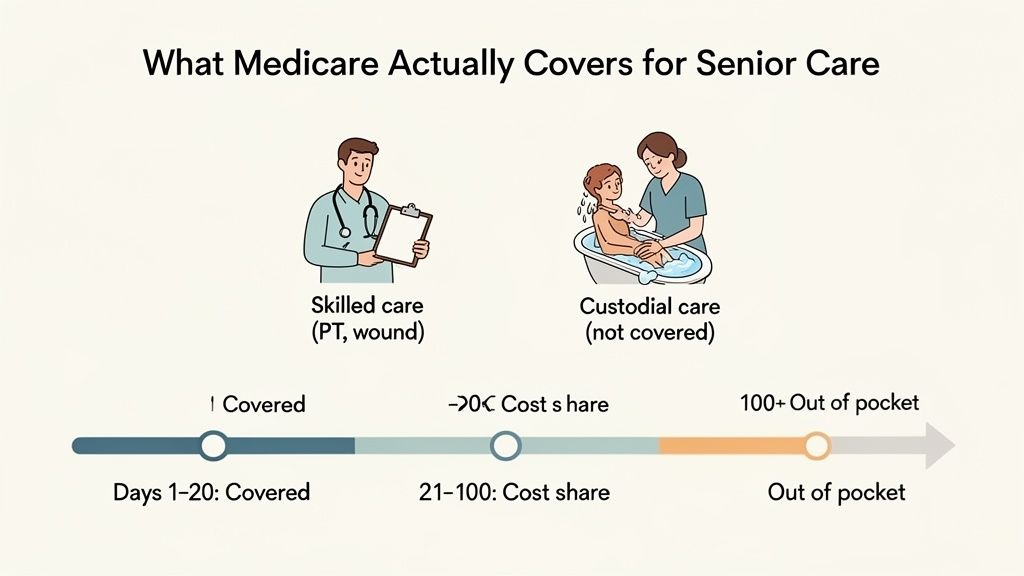

One of the most painful financial shocks a family can face is discovering that Medicare will not pay for assisted living or an ongoing nursing home stay. It feels wrong, but it's the reality. Medicare’s role in long-term care is extremely limited and temporary.

Getting this wrong isn't just confusing; it can be financially devastating, leaving families with surprise bills that can easily top $10,000 per month.

The 100-Day Myth Explained

You've likely heard someone mention Medicare's "100 days" of coverage. This is dangerously incomplete information. Medicare Part A only helps pay for a Skilled Nursing Facility (SNF) under very specific rules, and only after a qualifying 3-day inpatient hospital stay.

Here’s the real breakdown:

-

Days 1–20: Medicare covers 100% of the approved amount.

-

Days 21–100: You pay a daily copayment ($204 per day in 2024).

-

Day 101 and beyond: You are responsible for 100% of all costs.

This system is designed for rehabilitation with the goal of sending the patient home. It was never intended to fund a permanent stay.

A Cleveland Scenario: The Cost of Misunderstanding

Imagine your dad, who lives in Lakewood, has a fall and is discharged from a West Side hospital to a rehab facility. For the first three weeks, Medicare covers everything. Then, you get a bill with a daily charge of over $200. A few months later, on day 101, he’s still not safe to return home, and you're suddenly handed a private pay bill for over $10,000 for the upcoming month. This happens every day in Northeast Ohio.

Skilled Care vs. Custodial Care

The core of the issue comes down to two types of care. Medicare only pays for one.

-

Skilled Care: Medical services performed by a licensed professional (nurse, therapist). Think IVs, wound care, or physical therapy. This is what Medicare covers.

-

Custodial Care: Non-medical help with Activities of Daily Living (ADLs) like bathing, dressing, eating, and mobility. Medicare does not cover custodial care.

The moment a patient's care needs shift from "skilled" to "custodial," Medicare coverage ends—even if it's only day 15. For more details, learn more about what Medicare covers in our detailed guide.

Insider Tip: A hospital discharge planner’s job is to ensure a safe discharge, not to be your financial advisor. It's on you to ask the tough questions about what happens when the Medicare money runs out.

Questions to Ask the Hospital Discharge Planner

Be your family's advocate. Use this checklist to get the answers you need before agreeing to any facility.

-

"What specific skilled care needs does my loved one have that require an SNF?"

-

"Realistically, how long do you expect Medicare to cover this stay?"

-

"Does this facility accept Ohio Medicaid for long-term care after Medicare ends?"

-

"Do they have a 'Medicaid-pending' bed available now, or will we have to move?"

-

"Who is the facility's financial coordinator, and can we speak with them today?"

How Ohio Medicaid Becomes the Financial Lifeline

When the 100-day Medicare clock runs out, the reality of a $10,000+ monthly bill hits hard. This is where Ohio Medicaid becomes the essential long-term solution for thousands of families across the state.

In Ohio, Medicaid isn't just a health insurance program; it's the primary payer for long-term care. It can take over when Medicare stops paying for a nursing home, and crucially, it can help pay for care in an assisted living community through programs like the Assisted Living Waiver. For families from the East Side to the West Side, understanding this is the key to creating a care plan that doesn't lead to bankruptcy.

Ohio's Key Medicaid Waiver Programs

To avoid forcing people into nursing homes, Ohio offers Home and Community-Based Services (HCBS) waivers. These programs use Medicaid funds to pay for care in less restrictive settings. For seniors in Greater Cleveland, two waivers are critical:

-

Assisted Living (AL) Waiver: The game-changer. This program helps pay for the care services received in an assisted living facility (officially called a Residential Care Facility or RCF in Ohio).

-

PASSPORT Waiver: This program provides services to help a senior stay safely in their own home for as long as possible.

Knowing these programs exist is one thing. Finding a quality community that accepts the waiver and has an available spot is the real challenge.

Insider Tip: A facility's marketing team might say they "accept Medicaid," but that doesn't mean they have an AL Waiver spot open today. These spots are extremely limited and can have long internal waitlists. Availability changes daily, and you won't find this information in a brochure.

Untangling "Base Rent" vs. "Level of Care" Fees

The AL Waiver doesn't pay for everything. Assisted living costs are split into two parts:

-

Base Rent (Room and Board): This covers the apartment, meals, and utilities. The resident pays for this, typically using their Social Security or other income.

-

Level of Care Fees: This is the charge for hands-on assistance like medication management, bathing, and dressing. The AL Waiver helps pay for this portion.

An applicant must have enough income to cover the base rent while still meeting Medicaid's strict financial limits—a tricky balancing act.

A Cleveland Scenario: The Waiver Waitlist

A family from Parma spent weeks searching for memory care for their dad. They toured several beautiful communities near them, found the perfect one, and started the application—only to be told the facility had a six-month waitlist for its AL Waiver spots. All that time and emotional energy were wasted. A quick call to a local advisor would have saved them the heartache by starting with a list of communities with current waiver availability.

The Intimidating but Manageable Application Process

Applying for Medicaid is complex. In Ohio, the application goes through your county's Department of Job and Family Services. For our area, that means dealing with Cuyahoga, Lake, Lorain, or Medina county offices. An applicant must meet strict income and asset limits, and a small mistake on the application can lead to denial.

Our detailed guide can help you understand the process: https://www.guideforseniors.com/blog/medicaid-assisted-living-ohio.

You don't have to do this alone. A Senior Advisor can connect you with trusted local resources, like elder law attorneys, who can ensure the application is handled correctly the first time.

Understanding MyCare Ohio for Dual-Eligible Seniors

Some seniors in Ohio qualify for both Medicare and Medicaid at the same time. These individuals are called "dual-eligible." To simplify their care, Ohio created a program called MyCare Ohio.

Think of MyCare as a single, coordinated system that bundles all Medicare (doctors, hospitals) and Medicaid (long-term care) benefits under one managed care plan. This is designed to create a seamless experience, especially when a person moves between care settings—like from a stay at UH to a rehab facility near Crocker Park.

How MyCare Ohio Works in Practice

Here in Greater Cleveland, MyCare plans are managed by familiar names like CareSource and Molina Healthcare. The managed care organization becomes the gatekeeper for all services, from doctor's appointments to the services covered by the Assisted Living Waiver. Each member gets a care manager whose job is to coordinate everything and prevent gaps in care.

Insider Tip: You will never see "MyCare Ohio" advertised in an assisted living brochure. It's a critical operational detail, not a marketing feature. But knowing how it works is an insider's key to understanding how care is actually managed and paid for long after you've taken the tour.

A Major Statewide Change Is Coming

MyCare Ohio is currently available in 29 counties, including Cuyahoga. Starting in 2026, the program is expanding to all 88 counties in Ohio. This is a significant change for long-term care across the state. You can read more about the upcoming MyCare Ohio changes and their impact.

What This Means for Your Family's Search

This is critical: not all assisted living communities contract with every MyCare plan. Choosing a community that isn't in your loved one's network can cause massive billing issues and may even force them to switch doctors.

A Cleveland Scenario: The MyCare Mismatch

A Medina family moved their dad into an assisted living they loved. A month later, they discovered his long-time primary care doctor, based near University Circle, was out-of-network with the community's contracted medical group. His specific MyCare plan wasn't compatible, creating a logistical nightmare and forcing them to find a new doctor unexpectedly. This is completely avoidable.

A Senior Advisor can instantly verify which communities are in-network with a specific MyCare plan. Don't guess. Speak to a Cleveland-based Senior Advisor for free to narrow your list.

The Financial Reality of Long-Term Care in Cuyahoga County

The glossy brochures show happy seniors, beautiful dining rooms, and lush gardens. What they don't show is the bill. Facing the real costs of care in Northeast Ohio is the most important step in creating a plan that won't bankrupt your family.

State-sourced data shows the average cost for a semi-private room in a Cleveland-area nursing home is projected to be $121,297 per year by 2026 (source: medicaidplanningassistance.org). With Medicare coverage ending after 100 days at most, families are left to face these staggering costs alone.

-

Semi-Private Room: Often exceeds $10,000 per month.

-

Private Room: Can easily reach $11,000 to $12,000 per month or more.

(Costs updated: October 2024. As of Oct 2024, these are state-sourced estimates and can vary.)

Assisted Living: More Affordable, But Still a Stretch

While less expensive than a nursing home, assisted living in areas like Solon, Westlake, or Beachwood is still a major financial commitment. Costs are typically split:

-

Base Rent: Covers the apartment, meals, and amenities.

-

Level of Care Fees: An extra charge for hands-on help.

The Ohio Medicaid AL Waiver is the lifeline that makes this option possible for many, as it helps cover the "Level of Care" fees. But finding a community that accepts the waiver and has an opening is the needle in the haystack. For a starting point, see our guide to assisted living facilities that accept the Medicaid waiver in Cuyahoga County.

Insider Tip: The one-time "Community Fee" you're quoted during a tour is often negotiable. This fee can be thousands of dollars. An advisor can tell you when and how to ask for a reduction.

The Cost of Inaction: A Cleveland Scenario

A family in Solon spent three weeks touring facilities, only to find out their top choice didn't accept the AL Waiver. A quick check with a local advisor would have saved them that time, stress, and heartache by providing a pre-vetted list of communities that were actually a financial fit.

Don't let this happen to you. Pricing and availability change daily.

Click here to get a current Rate Sheet for communities in your area.

Your Next Steps to Finding the Right Care

You now understand the difference between Medicare and Medicaid. You know the real costs. The next step is to turn this knowledge into an action plan. This is where most families get stuck.

You can spend another weekend driving all over town, collecting brochures, and trying to compare apples to oranges. Or you can make one phone call and get a clear, unbiased path forward from a local expert whose only goal is to help you find the right solution.

The True Cost of Going It Alone

A family from Solon spent three stressful weeks touring beautiful assisted living communities, from the East Side near University Circle all the way to the West Side near Crocker Park. They fell in love with a community, put down a deposit, and began the paperwork, only to discover that the facility didn't accept the AL Waiver. They had wasted valuable time and emotional energy on an option that was never going to be financially sustainable for their mother.

The Hard Truth: A single, five-minute phone call with a local Senior Advisor would have saved them all that heartache. An advisor could have immediately provided a curated list of communities that met their mom's care needs, fit her budget, and had current openings for the AL Waiver.

Your Path from Research to Relief

You don’t have to do this alone. Guide for Seniors is your local concierge service, providing the insider knowledge you need to make a confident decision. Our guidance is 100% free for families.

We are your advocates. We know the communities, we understand their real costs (not just the advertised "starting at" price), and we know which ones have waiver spots available this week. This is your direct path to finding the right care without the guesswork.

Here are two simple ways to get clarity right now:

-

Get a Custom Report: We'll build a personalized list of communities in your target area (like Westlake, Beachwood, or Medina) that match your specific care needs and financial reality.

-

Speak with an Advisor: Talk to a Cleveland-based expert who can answer your questions, help you understand your options, and arrange tours at communities that are actually a good fit.

Don't guess. Speak to a Cleveland-based Senior Advisor for free to narrow your list.

Disclaimer: This article provides informational guidance and should not be considered legal or financial advice. Please consult with a qualified professional for personalized counsel.

Frequently Asked Questions About Long-Term Care

Understanding the basics of Medicare vs. Medicaid is just the first step. Here are answers to the practical questions that come next for families in Northeast Ohio.

What Is the First Thing I Should Do If a Loved One Needs Care?

Before you tour a single community, get a professional assessment of your loved one's care needs. You need an objective evaluation to know if they require assisted living, memory care, or skilled nursing. Choosing a beautiful community near University Circle is a mistake if it can't handle advancing dementia. An advisor can help you find the right resources for an honest assessment, ensuring you start your search on the right track.

Can a Person Have Too Many Assets to Qualify for Medicaid?

Yes. This is the single biggest barrier for most families. In Ohio, an individual can typically have no more than $2,000 in countable assets to qualify for Medicaid (As of 2024, source: Ohio Department of Medicaid). The rules on what "counts" are incredibly complex. A primary home and one car are often exempt, but making a mistake—like giving money to your kids—can trigger a penalty period, making your loved one ineligible for benefits when they need them most.

Insider Tip: Never try to "spend down" assets on your own. This is a legal and financial minefield. A single error can disqualify your loved one from Medicaid for months or years. A local elder law attorney is your essential partner in this process. Your Senior Advisor can connect you with trusted professionals.

Do All Assisted Living Communities Accept the Medicaid Waiver?

No. This is a critical truth the brochures won't tell you. Only a fraction of communities in the Cleveland area are certified to accept the Ohio AL Waiver. Of those, most have a very limited number of "waiver beds" with long internal waiting lists. A community may claim they "work with Medicaid," but that is not a guarantee they have a spot open today. This availability changes constantly.

Don't waste time chasing options that aren't really available. Speak to a Senior Advisor for free to get a current, targeted list of options.

Find Medicaid-Approved Communities Near You

Looking for a facility that accepts the Ohio Medicaid Assisted Living Waiver? Browse communities in these Cleveland suburbs:

Medicaid waiver communities on Cleveland's west side

East side communities accepting Ohio Medicaid

Affordable Medicaid options in south suburbs

Near-west Medicaid-approved communities

Southwest suburban Medicaid facilities

Central location with waiver-approved care

Need help navigating Medicaid? Our local advisors provide free guidance →

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.