Your Guide to Medicaid for Assisted Living in Ohio

-

What it is: Ohio Medicaid helps pay for assisted living care through a program called the Assisted Living Waiver (AL Waiver).

-

What it covers: The AL Waiver pays for care services (like help with bathing, dressing, and medications), but not for room and board (rent).

-

Who qualifies: To be eligible, a person must meet strict medical and financial limits set by the state.

-

How to start: The first step is to contact your local Area Agency on Aging to begin the assessment process.

Who This Guide Helps

This guide is for families in Greater Cleveland and Northeast Ohio who are feeling stressed and overwhelmed by the cost of senior care. If you're comparing options like assisted living or memory care and wondering if Medicaid can help make it affordable, you're in the right place. We'll give you clear, calm, and solution-oriented answers for Cuyahoga, Lake, Lorain, Geauga, Medina, and Summit counties.

Key Takeaways

We’ll break down the entire process, but here are the most important things to know upfront.

What This Means for You

- Medicaid doesn't pay the whole bill. The AL Waiver is a huge help, but you will still need to pay for room and board, usually from the resident's income (like Social Security).

- Eligibility is strict. It’s not automatic. Your loved one must be medically assessed and qualify for a nursing home level of care while staying under Ohio's income and asset limits.

- Not every community accepts the waiver. You must choose a community that is certified by the State of Ohio to participate in the program.

- Your first call is local. The process begins with a call to your regional Area Agency on Aging (AAA), not the Medicaid office.

Now, let's dig into how the Ohio Medicaid program for assisted living actually works.

How Ohio's Assisted Living Waiver Program Works

In Ohio, Medicaid helps pay for assisted living through a specific program called the Medicaid Assisted Living Waiver (AL Waiver). Think of it as a scholarship for the care part of assisted living. It helps cover the cost of hands-on support services your loved one receives, but not the "rent" for their apartment.

The goal of the AL Waiver is to give seniors who medically qualify for a nursing home the choice to receive similar care in a more independent, homelike setting. This is about preserving dignity and quality of life. The program is overseen by the Ohio Department of Aging, but your starting point is your regional Area Agency on Aging (AAA). For families in the Cleveland area, that is the Western Reserve Area Agency on Aging.

What the AL Waiver Covers (and What It Doesn't)

The AL Waiver is designed to pay for services that help a person with their daily health and personal care needs. It is not a blank check.

| Service or Cost | Covered by AL Waiver? | Resident's Responsibility |

| :--- | :--- | :--- |

| Apartment Rent (Room & Board) | No | Yes - Paid from resident's income |

| Personal Care (e.g., bathing) | Yes | No |

| Medication Management | Yes | No |

| Meals (cost of preparation) | Yes | Yes (for the cost of raw food, part of room & board) |

| Housekeeping & Laundry | Yes | No |

| Cable, Phone, Internet | No | Yes - Paid separately |

Understanding this financial division is key to creating a realistic long-term care budget.

Qualifying for Medicaid Assisted Living in Ohio

To qualify for the AL Waiver, a person must meet three main types of requirements: medical, financial, and basic residency.

-

Medical Need: The applicant must require a nursing home level of care. This means they need enough daily help that they would otherwise need to be in a skilled nursing facility. This is determined through an in-person assessment by the Area Agency on Aging.

-

Financial Limits: The applicant must have income and assets below state-mandated limits.

-

Basic Requirements: They must be an Ohio resident, at least 65 years old (or younger with a qualifying disability), and have needs that can be safely met in an assisted living setting.

Ohio's Financial Eligibility Rules (As of March 2025)

These numbers can change, so always confirm the current limits with your county's Job and Family Services office or AAA.

| Eligibility Factor | Individual Applicant |

| :--- | :--- |

| Monthly Income Limit | ~$2,829 per month |

| Countable Asset Limit | $2,000 |

Note: These figures are for 2024 and are subject to annual adjustments. There are different rules for married couples.

What if Assets Are Too High? The "Spend-Down"

Many families worry when they see the $2,000 asset limit. In Ohio, a person can become eligible by "spending down" their excess assets on approved medical or long-term care expenses.

Example: Cuyahoga County Family Spends Down Assets

A resident in Cuyahoga County has $20,000 in savings, which is $18,000 over the asset limit. To qualify for the AL Waiver, her family uses that excess money to pay for her first few months of assisted living out-of-pocket. They also purchase a pre-paid funeral plan, which is an exempt asset in Ohio. Once her countable savings are below the $2,000 threshold, she becomes financially eligible for Medicaid.

AL Waiver Eligibility Checklist

Use this checklist to see if applying is the right next step.

-

Is the applicant an Ohio resident?

-

Is the applicant 65 or older (or disabled)?

-

Do they need daily help with activities like bathing, dressing, or meals?

-

Without this help, would they likely need a nursing home?

-

Is their monthly income below Ohio's limit (around $2,829 for one person)?

-

Are their countable assets below Ohio's limit ($2,000 for one person)?

-

Are they willing to live in a community certified for the AL Waiver?

If you answered "yes" or "maybe" to these, your next step should be a call to the Area Agency on Aging.

Your Step-by-Step Guide to the Application Process

Navigating the application for the AL Waiver can feel complex, but it follows a clear path. Breaking it down into steps makes it much more manageable.

Step 1: Contact Your Local Area Agency on Aging

Your first phone call is to your regional Area Agency on Aging (AAA). For families in Cuyahoga, Geauga, Lake, Lorain, and Medina counties, this is the Western Reserve Area Agency on Aging. They will conduct a brief phone screening and, if appropriate, schedule the in-person assessment.

Step 2: Complete the In-Person Assessment

A nurse or social worker from the AAA will visit to determine if your loved one meets the medical requirements. This is where they will officially assess if the person needs a nursing home level of care. Be prepared to give a complete and honest description of their daily struggles and care needs.

Step 3: Submit the Financial Medicaid Application

Once the AAA confirms medical eligibility, you must apply for Medicaid through your county's Department of Job and Family Services (JFS). This requires detailed financial documentation. Gathering documents like bank statements, proof of income, and insurance policies ahead of time will speed up the process.

Step 4: Find a Participating Community

The final step is to find an assisted living community (officially called a Residential Care Facility in Ohio) that is certified to accept the AL Waiver. Not all do. Your AAA case manager can provide a list of local options.

Understanding the Real Costs and Financial Details

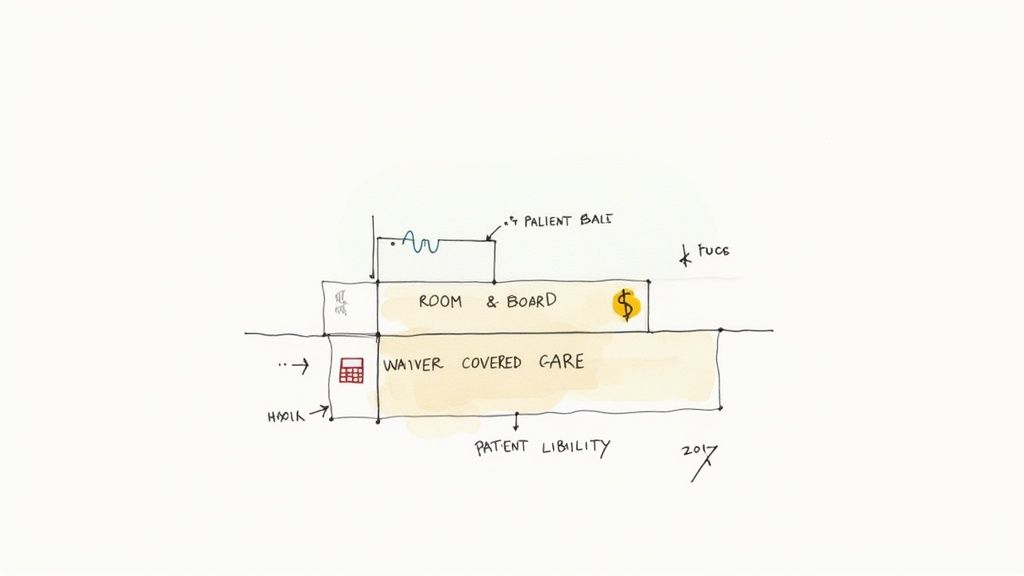

When looking at a bill, you'll see different charges. The AL Waiver helps with some, but not all.

-

Base Rate (Room & Board): This covers the apartment, utilities, and meals. The AL Waiver does not pay for this. The resident pays for this from their income.

-

Level-of-Care Fees: This is the charge for hands-on support like medication help or bathing assistance. This is what the AL Waiver is designed to cover. Jargon alert: these fees are sometimes called "care charges" or "service fees."

-

One-Time Fees: A move-in or "community fee" is common. These are typically not covered.

Calculating Your Monthly Out-of-Pocket Cost

The amount a resident must pay toward their room and board is called Patient Liability. The formula is simple:

(Resident's Monthly Income) - (Personal Needs Allowance) = Patient Liability

In Ohio, the Personal Needs Allowance is $50 per month (as of March 2025). This is money the resident keeps for personal items.

Example Cost Calculation

A resident receives $1,500/month from Social Security.

-

$1,500 (Monthly Income)

-

- $50 (Personal Needs Allowance)

-

= $1,450 (Patient Liability)

In this scenario, the resident pays $1,450 to the assisted living community each month. The AL Waiver pays the community separately for all approved care services. While Medicaid is a critical tool, it is wise to understand other options like the real long term care insurance costs.

What to Do Next

You don't have to navigate this alone. Here are concrete steps you can take right now.

-

Check Eligibility: Call the Western Reserve Area Agency on Aging at (877) 770-5558. This is your official first step to start the screening process for the AL Waiver.

-

Find Certified Communities: Use the state's official Ohio Long-Term Care Consumer Guide to search for assisted living facilities in your county that accept the waiver. You can also get more tips in our guide on choosing the right senior living option.

-

Organize Legal Documents: Ensure you have a Power of Attorney for healthcare and finances in place. Understanding the critical importance of Power of Attorney will make managing care and financial decisions much easier.

-

Report a Concern: If you ever have concerns about care quality in any facility, contact the local Long-Term Care Ombudsman program at (216) 696-2719. They are a free, confidential advocate for residents.

Disclaimer: This article is informational and not legal, financial, or medical advice. Please consult with qualified professionals like an elder law attorney for guidance on your specific situation.

#

<!-- FAQ rendered separately -->Find Medicaid-Approved Communities Near You

Looking for a facility that accepts the Ohio Medicaid Assisted Living Waiver? Browse communities in these Cleveland suburbs:

Medicaid waiver communities on Cleveland's west side

East side communities accepting Ohio Medicaid

Affordable Medicaid options in south suburbs

Near-west Medicaid-approved communities

Southwest suburban Medicaid facilities

Central location with waiver-approved care

Need help navigating Medicaid? Our local advisors provide free guidance →

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.