How to Apply for Ohio AL Waiver: Step by Step Guide for Cleveland Families

Applying for the Ohio Assisted Living Waiver is a multi-step process. Here’s the bottom line:

-

Who it helps: Seniors in Greater Cleveland who need hands-on care but can’t afford the full private-pay rate for assisted living, which often runs $5,000-$8,000 per month.

-

Why it's hard alone: It involves coordinating three separate entities: the Area Agency on Aging for a medical assessment, the County for a deep financial review, and finding a community that actually accepts the waiver and has an open spot.

-

The first step: Before you tour or fill out a single form, confirm your loved one is likely to meet the medical and financial rules. A free check with a local Senior Advisor can save you weeks of wasted effort.

-

The biggest mistake: Falling in love with a community near you—say, in Westlake or Solon—only to find out it doesn't accept the AL Waiver or has a two-year waitlist.

The real key to success is coordinating these three main parts—eligibility, assessment, and placement—to sidestep frustrating delays or a potential denial. Think of this guide as your insider's map, specifically for families here in the Greater Cleveland area.

Your Quick Guide to the Ohio AL Waiver Application

Trying to figure out senior care options around Greater Cleveland can feel like a second job. You're sorting through brochures with glossy photos of chandeliers and happy hours, but the real worry is much simpler: Can we actually afford this, and will Mom get the care she truly needs? This question becomes even more pressing when you hear about the Medicaid Assisted Living (AL) Waiver.

Applying isn't just about paperwork. It's a strategic journey that can feel confusing and disjointed if you're trying to manage it alone. A common question I hear from families in Cuyahoga County and the surrounding suburbs is who to call first—the assisted living community or a government agency?

Insider Tip: A family in Solon spent three weeks touring facilities, only to find out their top choice didn't accept the AL Waiver. A quick check with a local advisor would have saved them that time and immense frustration by providing a pre-vetted list of waiver-certified communities on the East Side.

This guide is your roadmap to securing the Ohio AL Waiver. We are the neutral party who translates marketing fluff into reality. While brochures highlight the chandeliers, you need to ask about the weekend staffing ratios. We’ll show you how to skip the confusion and get straight to viable, waiver-accepting options so you can focus on what matters most.

Ohio AL Waiver Application at a Glance

To make this easier, I've broken down the core phases of the application. This table turns a complex government process into a clear roadmap for families right here in our area.

| Phase | What It Means for Your Family | Key Contact in Cuyahoga County |

| :--- | :--- | :--- |

| Eligibility Verification | This is where you confirm your loved one meets the specific medical and financial rules set by the state. It involves gathering documents and understanding income/asset limits. | A Senior Advisor at Guide for Seniors can provide a free, preliminary eligibility check. |

| Level of Care Assessment | A nurse from the local Area Agency on Aging (AAA) will conduct an in-person assessment to certify that your parent needs "nursing home level of care." | Western Reserve Area Agency on Aging (WRAAA) is the designated agency for Cuyahoga and its neighboring counties. |

| Financial Application | You will submit a detailed Medicaid application to the county. This is the most document-intensive part of the process. | Cuyahoga County Department of Job and Family Services (DJFS). |

| Finding a Community | Simultaneously, you must find an assisted living community that is certified by the state to accept the AL Waiver and has an available spot. | Guide for Seniors provides current lists of waiver-certified communities and their availability. |

Think of this table as your "who to call and when" cheat sheet. Following this sequence and knowing the right contacts in advance can make all the difference in having a smooth application experience.

Are You Eligible for the Ohio Assisted Living Waiver? Let's Find Out.

Before you dive into the paperwork, let’s take a moment to see if the Ohio Assisted Living (AL) Waiver is the right fit. I've seen too many families invest precious time and emotional energy into an application, only to hit a wall because of a misunderstanding of the rules.

Understanding the state's requirements upfront can save you from that frustration. This isn't just about ticking boxes; it's about making sure your loved one's situation truly aligns with what the program is designed to do.

The eligibility puzzle comes down to three key pieces: medical need, financial situation, and some basic residency facts. Getting these right is the bedrock of a successful application. While the rules can seem rigid, the reality for many Greater Cleveland families is often more nuanced than what you'll find on a government website.

I once worked with a family in Shaker Heights who were certain their father's savings disqualified him from the AL Waiver. They had no idea that in Ohio, a spouse's assets can often be protected under specific Medicaid rules. A quick chat revealed he was likely eligible all along, which saved them from burning through their life savings on private-pay care.

This happens all the time. Families across Cuyahoga, Lake, and Lorain counties often misread the guidelines, which can be a costly mistake. Let’s break down exactly what the state is looking for.

The Three Pillars of Ohio AL Waiver Eligibility

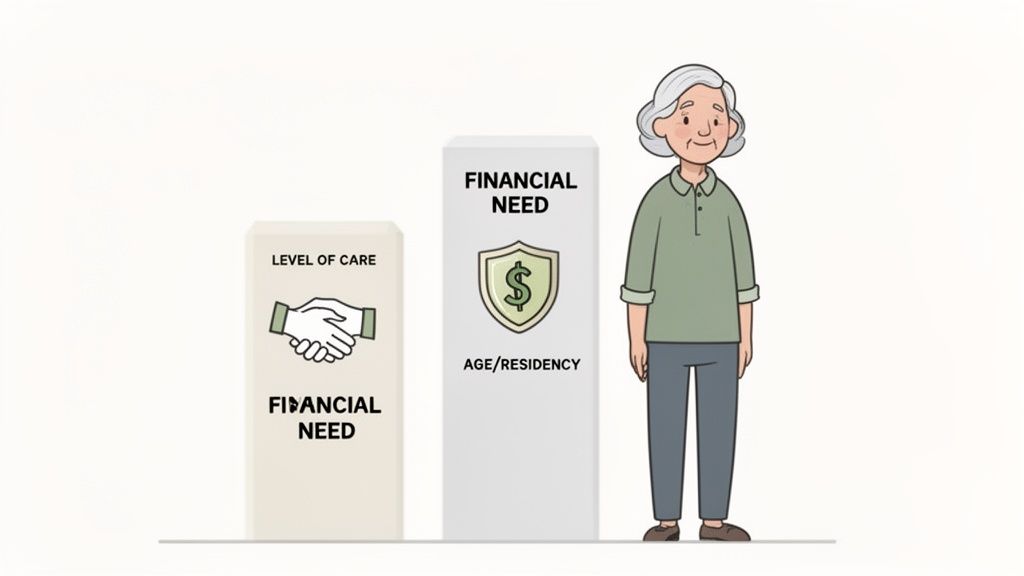

Think of eligibility as a three-legged stool. If any leg is shaky, the whole thing can topple. You absolutely have to meet all three of these criteria.

-

Pillar 1: Level of Care Need

-

Pillar 2: Financial Limits

-

Pillar 3: Age and Residency Requirements

It’s easy to get lost in the details, so let's translate the official jargon into what it actually means for a senior living in our community.

Pillar 1: What "Intermediate Level of Care" Really Means

In Ohio, an applicant must need an "Intermediate Level of Care." This is bureaucratic language for needing the kind of hands-on help that is typically found in a nursing home, even though the goal is to receive that care in an assisted living setting.

This doesn't mean your parent has to be bedridden. Far from it. In practice, it usually means they need direct, hands-on help with at least two "Activities of Daily Living," or ADLs.

Questions to Ask to Determine Level of Care:

-

Bathing: Does Mom or Dad need someone to physically help them get into the shower or with the act of washing?

-

Dressing: Do they require assistance to put on clothes, manage zippers or buttons, or get socks and shoes on?

-

Toileting: Do they need help to get on and off the toilet or with hygiene afterward?

-

Transferring: Do they require physical help to move from a bed to a chair or from sitting to standing?

-

Eating: Do they need assistance with the physical act of eating, not just with meal prep?

While a nurse from the local Area Agency on Aging makes the official call, knowing these benchmarks helps you gauge if you're on the right track from the start.

Pillar 2: Understanding the Financial Requirements

This is the part that trips up most families. The financial rules are strict, but they're also not as simple as a yes or no. For a much deeper look, check out our complete guide to Ohio's Medicaid rules for assisted living.

Here are the key financial numbers in Ohio as of [Current Month/Year]:

| Category | Limit for a Single Applicant | Details for a Married Couple |

| :--- | :--- | :--- |

| Monthly Income | $2,829 | The applicant's income must fall under this limit, but the spouse's income has special protections. |

| Countable Assets | $2,000 | The non-applicant spouse (the "community spouse") can keep a much higher amount of assets. |

These numbers can look scary. But remember, things like a primary home, one car, and pre-paid funeral plans are usually exempt and not counted toward that $2,000 limit. The secret is knowing what's "countable" and what isn't—a distinction that can make or break an application.

Pillar 3: The Basic Age and Residency Rules

The final piece of the puzzle is the most straightforward. To qualify for the AL Waiver in Ohio, your loved one must:

-

Be at least 21 years old.

-

Be a resident of Ohio.

-

Plan to move into an assisted living community that is certified by the state to accept the waiver.

A critical first step in the process involves a formal assessment from your local Area Agency on Aging (AAA). This evaluation officially determines if you meet the 'Intermediate Level of Care' requirement. As new data for 2026 suggests, these financial limits and care requirements remain central to the state's approach. You can discover more insights about Ohio's senior budget priorities.

Making Your Way Through the Application Process

Let's be honest, the formal process for getting the Ohio Assisted Living Waiver can feel like a maze. It’s a journey with multiple steps and different agencies, each with its own set of rules and paperwork. When you're already juggling work, family, and the emotional weight of this transition, it's easy to feel completely overwhelmed.

We're going to walk through this together, not like you're reading a dry government checklist, but as a guided tour. Think of us as your local guide, pointing you in the right direction and helping you sidestep the common roadblocks families in Cleveland run into every single day. The goal is to make this process feel clear and, most importantly, manageable.

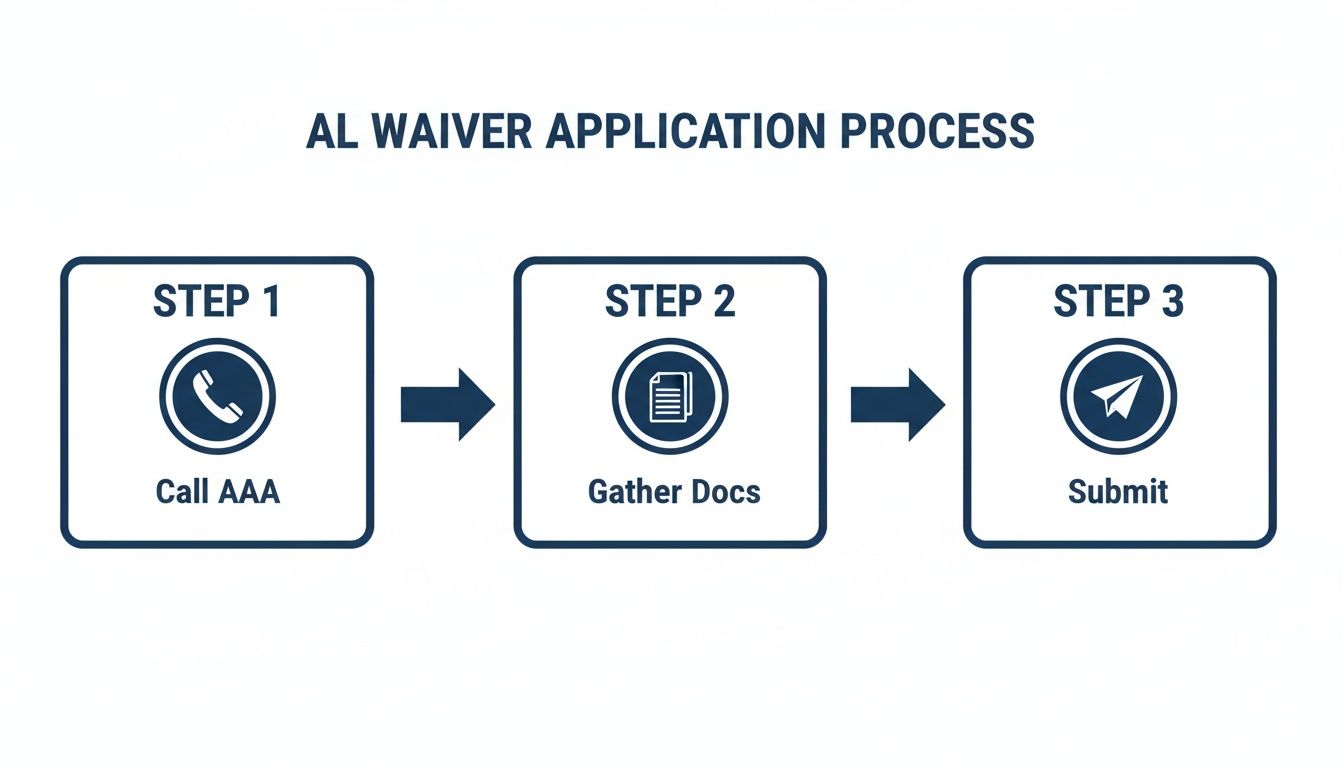

Your First Call: The Area Agency on Aging

Everything kicks off with a phone call to your local Area Agency on Aging (AAA). This is the official front door for any state-funded senior care program, so it’s the non-negotiable first step. For anyone living in Cuyahoga, Geauga, Lake, Lorain, or Medina counties, your starting point is the Western Reserve Area Agency on Aging (WRAAA).

An Insider's Tip: When you call the AAA, be very specific. Tell them you’re calling to get an assessment for the "Assisted Living Waiver." Using that exact phrase is key—it gets you routed to the right department and avoids any mix-ups with other home-based care programs.

This initial call sets in motion an in-person assessment. A nurse or social worker will schedule a visit with your loved one to determine if they meet the state's "Intermediate Level of Care" requirement. This is a mandatory checkpoint before you can even touch the financial application.

Contact Info for Greater Cleveland:

-

Agency: Western Reserve Area Agency on Aging (WRAAA)

-

Phone: You can reach their Aging and Disability Resource Network at (216) 621-0303.

-

Counties Served: Cuyahoga, Geauga, Lake, Lorain, and Medina.

If you're in Summit County, your contact is the Direction Home Akron Canton Area Agency on Aging. In Ohio, the application process itself is the same, but your starting point is different depending on your county.

Getting Your Paperwork in Order

Once that level-of-care assessment is on the calendar, it’s time to switch gears and gather all the necessary financial documents. The County Department of Job and Family Services (DJFS) is going to need a very detailed picture of your loved one's finances going back five years. This is easily the most document-heavy part of the entire application.

Getting organized right now will save you a ton of stress and frantic searching later.

Your Essential Document Checklist:

-

Proof of Identity: Birth certificate, driver's license, and Social Security card.

-

Income Verification: Social Security benefit letters, pension statements, and paperwork for any other monthly income.

-

Asset Statements: Bank statements (both checking and savings) for the last 60 months. This "five-year look-back" is non-negotiable and critical.

-

Insurance Policies: Information on any life insurance policies, making sure to include the cash surrender value.

-

Property Deeds: Documents for any real estate they own.

-

Annuity Statements: Details of any and all annuity contracts.

-

Pre-paid Funeral Contracts: If one exists, it’s often considered an exempt asset, so be sure to include it.

This can feel incredibly invasive, I know. But it's a required part of any Medicaid application, and the county has to verify that every financial eligibility rule has been met.

Submitting to Job and Family Services

With your documents in a neat pile and the care assessment finished, the next move is to submit the formal Medicaid application. This packet goes to your county's Department of Job and Family Services (DJFS). For families in Cuyahoga County, this is almost always the longest part of the journey.

A caseworker will be assigned to review every single piece of information you’ve provided. They'll verify income, scrutinize assets, and pay close attention to any financial transfers made during that five-year look-back period. Don't be surprised if they reach out to ask for more clarification or an extra document—it’s very common.

A Quick Story from Solon: We worked with a family from Solon who had spent three weeks touring beautiful facilities, only to find out their top choice didn't actually accept the AL Waiver. A quick conversation with an advisor at Guide for Seniors would have saved them all that time by focusing their search only on pre-vetted, waiver-certified communities. It really shows how important it is to work on finding a community while the paperwork is processing.

People often call this period "the waiting game." In Ohio, the DJFS has up to 90 days to process an application, and it's not unusual for them to use most of that time. This is exactly why you should never, ever wait until a crisis hits to start this process.

What to Do While You Wait for Approval

While the county is busy processing the financial application, your work isn’t over. In fact, this is the perfect time to start identifying assisted living communities that are actually certified to accept the waiver and have openings. It's a crucial step to take in parallel.

How to make the most of the waiting period:

-

Get a List of Waiver Communities: Not all facilities accept the waiver. Their participation can change based on their own census and financial situation.

-

Verify Availability: Just because a community is "approved" doesn't mean they have a "waiver bed" open. Availability can literally change from one day to the next.

-

Take VIP Tours: Visit the communities that seem like a good fit for your loved one's care needs, location preferences (East Side vs. West Side), and the room and board budget.

Trying to juggle all of this on your own while navigating the application is where so many families get burned out. An advisor can do the legwork of checking availability and setting up tours, which frees you up to focus on supporting your loved one.

The application process is definitely a marathon, not a sprint. By understanding each stage and preparing for what's ahead, you can move through it with much more confidence. Instead of getting bogged down in the weeds of paperwork, you can stay focused on the real goal: finding a safe, caring, and affordable home for your family member.

Finding a Cleveland Community That Accepts the AL Waiver

Getting that waiver approval letter in your hands is a huge relief, but it’s really only half the battle. Now you face the part that frustrates so many Greater Cleveland families: finding a wonderful community that is not only certified to accept the waiver but also has an open spot.

This is where all those glossy marketing brochures fall short. They’ll show you beautiful dining rooms and packed activity calendars, but they almost never mention the nuts and bolts of Medicaid certification. The reality is, not all assisted living facilities in Ohio are approved for the AL Waiver, and even the ones that are often have a very limited number of "waiver beds."

For a community, meeting the state's administrative requirements can be a heavy lift, which is why some choose not to participate at all. For you, this means the pool of available options is much smaller than it first appears, making an expert guide almost essential.

Why You Can’t Just Google It

Here’s the thing: availability for waiver-accepting communities changes constantly—sometimes daily. A list that was accurate last month could be completely useless today. This is where families waste the most time and energy, calling communities one by one only to hear, "Sorry, we don't accept the waiver," or "We have a two-year waiting list."

A family from Westlake recently told me they spent weeks touring gorgeous communities near Crocker Park for their mom. They found the perfect place, fell in love with it, and were ready to move forward. It wasn't until the final meeting that they were told the community wasn't AL Waiver certified. Their Senior Advisor at Guide for Seniors could have saved them that heartache from day one by providing a vetted list of waiver-certified memory care options that fit their budget and were close to home.

This story is incredibly common. Whether you’re on the East Side or the West Side, from Medina to Lake County, the challenge is the same. You need real-time information, not a generic, outdated directory you found online.

While the application itself is a clear sequence, finding and securing a spot in a community is a separate process that happens at the same time—and it requires someone who knows the local landscape.

Questions to Ask That Brochures Won’t Answer

When you do find a potential community, you need to dig deeper than the surface-level questions. The marketing team is trained to sell the lifestyle; your job is to pin down the reality of care and cost under the waiver.

Get straight to the point with these critical questions:

-

"Are you currently certified by the state of Ohio to accept the Assisted Living Waiver?" Don’t settle for a vague answer like "we work with Medicaid." You need to hear those specific words.

-

"Do you have any waiver spots available right now, or is there a waiting list?" If there's a list, find out how long it is and how they'll let you know when a spot opens up.

-

"Can you give me a clear breakdown of all costs? What is the monthly room and board fee that I will be responsible for?" Remember, the waiver covers the cost of care services, not the rent.

-

"What happens if my parent's care needs increase? Do you have the staff and services to handle that under the waiver?" You want to make sure they won't have to move again if their condition changes down the road.

Navigating this takes persistence and insider knowledge. For a targeted list to get you started, you can learn more about assisted living facilities that accept the Medicaid waiver in Cuyahoga County.

Your Next Step: Let Us Handle the Legwork

You’ve done the hard work of getting approved for the waiver. Don’t let this final, crucial step of finding the right home become another mountain to climb. The truth is, waiver availability and community pricing change far too often for any public list to be reliable.

Stop the endless, frustrating phone calls and confusing tours. Let a Cleveland-based Senior Advisor at Guide for Seniors do the heavy lifting for you. We maintain real-time data on which communities have openings right now.

Pricing and availability change daily. Click here to get a current Rate Sheet for waiver-accepting communities in your desired area.

Don't guess. Speak to a local Senior Advisor for free to immediately narrow down your list to viable options.

Navigating the Application: Common Pitfalls and How to Sidestep Them

Applying for the Ohio AL Waiver can feel like walking through a minefield. When you're under pressure, trying to get the best care for a loved one, it’s all too easy to make a small mistake that leads to huge delays or even a denial. These aren't just clerical errors; they have a real impact on families here in our community.

This is where the glossy facility brochures end and the reality of navigating the system begins. I've seen countless families from Parma to Painesville hit these same roadblocks. Let's walk through them so you can avoid them completely. Honestly, knowing what not to do is just as critical as knowing the right steps to take.

Assuming Room and Board Is Covered

This is, without a doubt, the biggest and most painful misunderstanding about the AL Waiver. I can't tell you how many families hear "Medicaid waiver" and think it means assisted living is now free. That is absolutely not the case, and finding this out late in the process can be financially devastating.

The waiver is designed to pay for the cost of care services. Think of things like hands-on help with bathing, managing medications, or getting dressed. It does not cover the monthly bill for room and board—that’s essentially the rent for your loved one's apartment.

You are always responsible for paying that room and board fee directly to the facility. This is typically paid using the resident's Social Security check, pension, or other income. It's a non-negotiable part of the arrangement.

Misunderstanding the Spend-Down Rules

The financial eligibility rules are strict, and the "spend-down" process is where so many applications get tripped up. A spend-down is necessary when your loved one’s countable assets are over the $2,000 limit. The idea is to legally and strategically reduce their assets to a point where they can qualify for Medicaid.

Here's the catch: you can't just start giving money away to family. Ohio Medicaid has what's called a five-year look-back period. They will scrutinize every financial transaction, and any large gifts or uncompensated transfers made during that time can trigger a penalty, delaying eligibility for months, sometimes even years.

I worked with a family in Medina who, with the best intentions, transferred their mother's savings to her grandson for his college fund right before applying. That gift, meant to help, instead triggered a significant penalty period. They were forced to private-pay for care they couldn't afford while they waited for the penalty to end. An advisor could have shown them permissible ways to spend down, like pre-paying for funeral expenses or making home modifications.

Spending down has to be done by the book, on approved expenses. This is one area where getting professional advice isn't just a good idea—it's essential to avoid a very costly mistake.

Waiting Too Long to Start the Process

A crisis is the worst time to make complex financial and healthcare decisions. The AL Waiver application isn't something you can complete overnight. From that first call to the Area Agency on Aging to the final approval from your county's Job and Family Services, the process can easily take 60 to 90 days, and often longer in a busy county like Cuyahoga.

If you wait until a fall or a major health event forces your hand, you'll likely be stuck paying the full private rate for care while the application slowly makes its way through the system.

Starting the conversation and the paperwork before you're in crisis mode gives you time, control, and options. It allows you to be proactive instead of reactive.

What the AL Waiver Covers vs. What You Pay

To make this perfectly clear, let’s break down the costs. Understanding this separation is fundamental to budgeting correctly and avoiding any surprises.

| Expense Category | Covered by AL Waiver? | Resident Responsibility (Private Pay) |

| :--- | :--- | :--- |

| Personal Care Services | Yes (Help with bathing, dressing, etc.) | No |

| Nursing Services | Yes (Medication administration, wellness checks) | No |

| Community Apartment Rent | No | Yes (Paid from resident's income) |

| Daily Meals | No | Yes (Included in the room and board fee) |

| Utilities and Housekeeping | No | Yes (Included in the room and board fee) |

| Social Activities | Typically No | Yes (Included in the room and board fee) |

As you can see, there are a lot of moving parts. Don't risk a denial or a costly delay because of a simple misunderstanding. A local Senior Advisor who knows the Cleveland-area system can review your situation and flag potential issues before you even submit the application.

Don't guess on the details. Speak to a local Senior Advisor for free to ensure your application is positioned for success.

Your Ohio AL Waiver Questions Answered

After digging into the application details, it's natural for more questions to pop up. This process has a lot of moving parts, and it’s completely normal to wonder what happens next.

Think of this as a chat with someone who's been through this hundreds of times. We’ll tackle the most common questions we hear from families across Greater Cleveland, from Lakewood to Mentor, and give you clear, straightforward answers.

How Long Does the Ohio AL Waiver Application Take?

Let's be realistic: you should plan for the entire process to take at least 60 to 90 days. That's from the day you first call the Area Agency on Aging to the moment you get an approval letter. In a busy county like Cuyahoga, it can sometimes stretch even longer.

What causes the delays? It usually comes down to a few common culprits:

-

Missing Paperwork: A single missing bank statement from the five-year look-back period can stall everything. This is the number one hold-up we see.

-

Caseworker Overload: Your county's Department of Job and Family Services is often juggling a massive number of applications.

-

Assessment Scheduling: Just getting the initial in-person assessment on the calendar can take a few weeks.

This is exactly why starting the process before a crisis hits is so critical. The waiting period is stressful enough without the added pressure of a sudden health decline.

What Happens If the Application Is Denied?

Getting a denial letter in the mail is tough, but it doesn't have to be the end of the line. Before you even think about a formal state appeal, your first job is to understand why it was denied and what your immediate alternatives are.

Was it a financial issue? Did they determine the applicant didn't meet the required level of care? Don't try to sort through the technical jargon on your own. A quick call with an experienced senior advisor can help you make sense of the denial and immediately pivot to other solutions, like exploring VA Aid & Attendance benefits or finding local programs that are a better fit.

Insider Tip: A denial feels final, but it's really just a new piece of information. An expert can help you re-strategize without losing precious time. It’s all about finding the right solution, even if it wasn't the first one you tried.

Can I Apply from a Neighboring County like Summit or Lorain?

Yes, absolutely. The Assisted Living Waiver is a statewide program, but it's managed at the county level. In Ohio, the rules are the same everywhere, but the specific people and processes you'll encounter are local.

This is where a Cleveland-based advisor becomes invaluable. They understand the nuances of the entire Northeast Ohio region, from the key contacts at the Area Agency on Aging serving Lorain and Medina to the team covering Summit County. This local knowledge can make the process much smoother, no matter which side of the Cuyahoga Valley National Park you call home.

The core steps for applying remain the same across county lines. A big piece of the puzzle is understanding the financials, and you can learn more about the monthly cost of assisted living to get a clearer picture.

Finding the right senior care is a journey, not a simple transaction. At Guide for Seniors, our local advisors are here with the map, the compass, and the support you need for every step. Stop guessing and start planning with confidence. Contact a Cleveland-based Senior Advisor for free today.

This article is for informational purposes only and does not constitute legal, medical, or financial advice. All state-sourced financial data is as of [Current Month/Year] and is subject to change.

Find Medicaid-Approved Communities Near You

Looking for a facility that accepts the Ohio Medicaid Assisted Living Waiver? Browse communities in these Cleveland suburbs:

Medicaid waiver communities on Cleveland's west side

East side communities accepting Ohio Medicaid

Affordable Medicaid options in south suburbs

Near-west Medicaid-approved communities

Southwest suburban Medicaid facilities

Central location with waiver-approved care

Need help navigating Medicaid? Our local advisors provide free guidance →

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.