How Much Is Assisted Living Per Month in Cleveland?

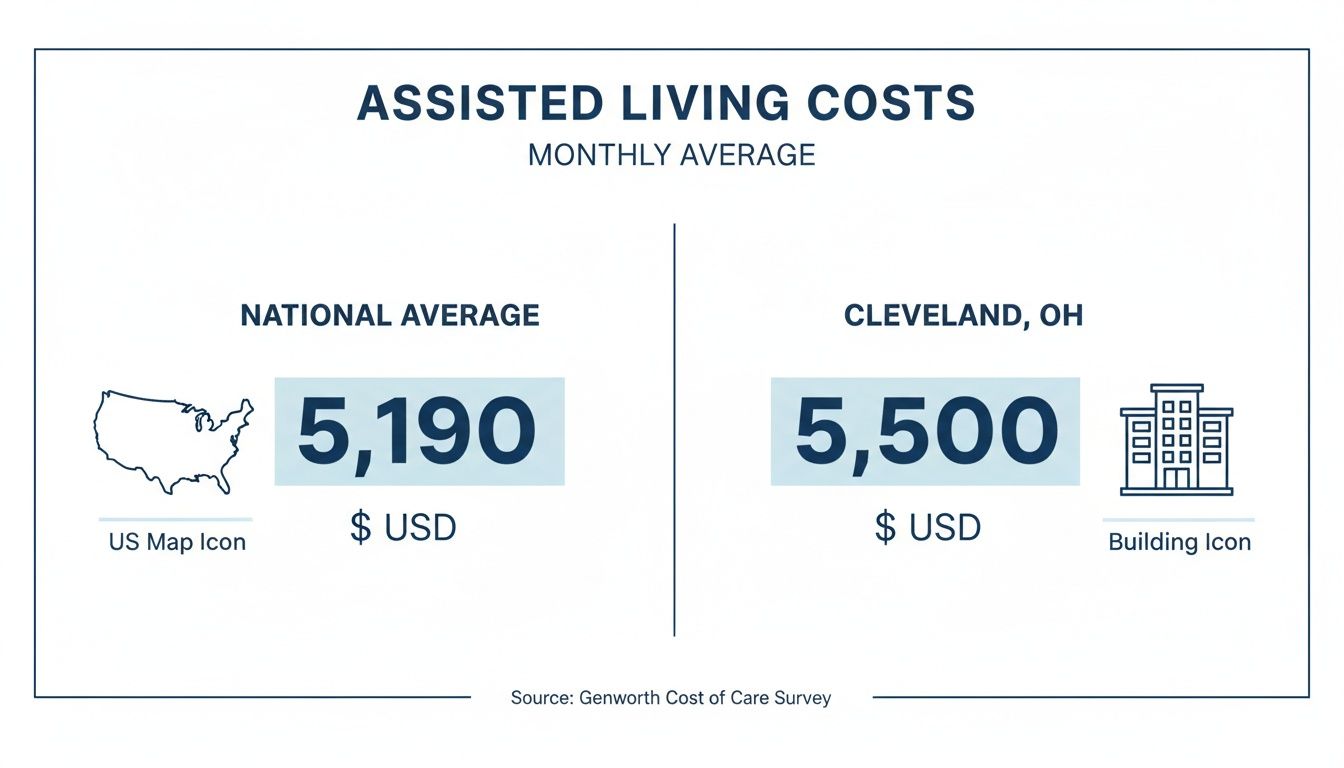

Trying to pin down how much is assisted living per month can feel overwhelming, especially when you're stressed and short on time. As of early 2025, the national median cost for assisted living is around $5,190 per month. Here in Northeast Ohio, prices are often a bit higher, reflecting our region's cost of living and high standards of care.

This guide is designed to give you clear, calm, and solution-oriented answers. We'll break down what you can realistically expect to pay in the Greater Cleveland area (Cuyahoga, Lake, Lorain, Geauga, Medina, and Summit counties) and walk you through the factors that influence the final monthly bill.

-

TL;DR: The Short Version

-

Cleveland vs. National Average: In the Cleveland area, expect assisted living to run about $5,500 per month, which is slightly higher than the national median of $5,190.

-

Costs Are Layered: Your monthly bill has three parts: a base rate (rent, meals, utilities), level-of-care fees (for hands-on help like bathing or medication management), and sometimes one-time fees (like a community move-in fee).

-

Help with Payment: While most families in Ohio pay with savings, you have options. Long-Term Care Insurance, certain VA benefits, and Ohio's Medicaid Assisted Living Waiver (AL Waiver) can significantly offset costs.

-

Ohio-Specific Program: The AL Waiver helps low-income seniors pay for the care services in assisted living, but not room and board.

Who This Helps

This guide is for families in Cuyahoga, Lake, Lorain, Geauga, Medina, and Summit counties comparing senior living options like assisted living, memory care, and nursing homes. We created this to be a practical resource to help you navigate an emotional process.

Key Takeaways

-

You'll get a clear picture of what raises or lowers monthly costs, from apartment size to the specific level of care needed.

-

We'll explain how to pay for care, including Ohio-specific programs many people don't know about.

-

You'll walk away with an actionable checklist to start your search with confidence.

Alt Text: A bar chart comparing the median monthly assisted living cost. The national average is $5,190, while the Cleveland, OH average is higher at $5,500. This data is based on early 2025 figures.

What this means for you: The $5,190 per month national median is a good starting point, but local costs matter more. Your final price will depend heavily on your location and, most importantly, your loved one's specific needs. To see the bigger picture, you can read the full long-term care cost report to compare different states.

Decoding the Monthly Assisted Living Bill

Alt Text: An illustrated invoice for assisted living. It clearly separates charges into three categories: Base Rate (e.g., $3,500 for rent & meals), Level-of-Care Fees (e.g., $1,200 for personal support), and One-Time Fees (e.g., $1,500 community fee).

When that first assisted living bill arrives, it can feel confusing. But once you understand how it's structured, it makes sense. Most invoices are built on three main components. Knowing these parts is the key to budgeting accurately and asking the right questions on a tour. It’s how you get a real answer to how much assisted living is per month.

The Base Rate: Your Foundation

The base rate is the starting point of every monthly bill. It’s a flat fee covering the essentials of day-to-day life—like rent, but with much more included.

What does the base rate typically include?

-

Housing: A private or semi-private apartment.

-

Utilities: Electricity, water, heat, and often cable and Wi-Fi.

-

Meals: Three meals a day in a dining room, plus snacks.

-

Housekeeping: Light cleaning and laundry services on a regular schedule.

-

Activities: Access to the community's social calendar, from fitness classes to group outings.

This rate covers the core experience every resident enjoys, regardless of their personal care needs.

Level-of-Care Fees: Personalized Support

This is where the cost is tailored to the individual. Level-of-care fees are extra charges for the specific, hands-on help a resident needs each day. Before move-in, a community nurse assesses your loved one to determine their needs.

This assessment looks at a person's ability to manage Activities of Daily Living (ADLs), a term for fundamental self-care tasks. The more help needed, the higher the care fees.

Common ADLs that shape these fees include:

-

Bathing and Dressing: Help with personal grooming and hygiene.

-

Medication Management: Reminders or having a nurse administer medications.

-

Mobility: Assistance with walking, transferring from a bed or chair, or using a walker.

-

Toileting and Continence Care: Support with using the restroom.

Communities often package these services into different care levels or tiers. "Level 1" might be for someone needing only medication reminders, while "Level 3" is for a resident needing significant help with bathing, dressing, and mobility. Each level has a set monthly fee added to the base rate.

One-Time and Ancillary Fees: The Extras

Finally, look for one-time fees and other potential charges. These aren’t part of the recurring monthly bill but will affect your initial budget.

What This Means for You: When touring a community in Cuyahoga or Lorain County, ask for a complete price list. Get the base rates for different apartment styles and ask to see their care level tiers. Getting this clarity upfront is the best way to avoid financial surprises.

Common one-time fees you might see include:

-

Community Fee: A one-time move-in fee covering administrative work and apartment prep.

-

Pet Fee: A one-time deposit or small monthly fee if a pet is moving in.

Ancillary services are optional extras like appointments at an on-site hair salon or transportation for personal errands. For a more exhaustive list, learn more about what is included in assisted living costs.

Why Do Assisted Living Costs Vary So Much in Ohio?

When you start looking at prices, the numbers can feel all over the map. One community in Cuyahoga County might quote a price hundreds or thousands of dollars different from another in Geauga or Medina County. There are specific reasons for these price swings. Understanding these cost drivers helps you compare options fairly.

Location, Location, Location

Just like housing, where a community is located plays a huge role in its price. A facility in a high-demand suburb like Westlake or Beachwood will almost always cost more than one in a quieter, more rural part of Northeast Ohio.

This is due to:

-

Higher property values and taxes.

-

Higher staff wages in competitive markets.

-

Local cost of living: Everything from food to maintenance costs more in certain areas.

What this means for you: If budget is a top priority, widening your search to include communities in neighboring counties like Lake or Lorain can often uncover more affordable choices without sacrificing quality.

Room Size and Type

The apartment your loved one moves into directly affects the monthly bill. Most communities offer a few floor plans, and the price jump between them can be significant.

Typically, you'll see these options:

-

Studio Apartment: The most budget-friendly choice, with living and sleeping areas in one space.

-

One-Bedroom Apartment: A step up in price and privacy with a separate bedroom.

-

Two-Bedroom or Companion Suite: The most expensive option, great for couples or someone who wants an extra room.

Amenities and Community Features

The perks a community offers factor into the price. A place with a resort-like feel—think indoor pools, fitness centers, and movie theaters—will have a higher price tag than a modest community focused on core care. One isn't better than the other; it depends on what you're looking for and what you're comfortable paying for.

Specialized Memory Care Services

If your loved one has Alzheimer's or another form of dementia, you'll likely look at a memory care neighborhood. These are secure, specially designed areas within an assisted living community (or a separate building) for residents with cognitive challenges.

Memory care costs more than traditional assisted living because the price covers:

-

Specially Trained Staff: Caregivers receive ongoing education on dementia care.

-

Higher Staff-to-Resident Ratios: More staff are available for one-on-one attention.

-

Secure Environment: The building is designed to prevent wandering with secured exits.

-

Targeted Programming: Activities are created to engage residents with memory loss.

For many families, this specialized care provides priceless peace of mind, but it's essential to plan for the higher monthly cost. National data shows costs can vary dramatically by state. You can read more about these statistics on assisted living costs at Caring.com.

How Families Pay for Assisted Living in Ohio

Alt Text: Four icons representing common ways to pay for assisted living in Ohio: a document for the Assisted Living Waiver, a piggy bank for savings, a medal for VA benefits, and a shield for long-term care insurance.

Once you know the monthly costs, the next question is, "How will we pay for this?" For most families in Ohio, the answer is a combination of resources. Understanding your options is key to building a sustainable financial plan.

Private Pay: The Most Common Method

Private pay means using your own financial resources to cover the bill. These funds typically come from a mix of sources:

-

Retirement Savings: 401(k), IRA, or other retirement accounts.

-

Pensions and Social Security: Applying this monthly income toward care costs.

-

Sale of a Home: Using home equity to fund several years of care.

-

Annuities or Investments: Drawing from other financial assets.

Most families blend these resources to meet monthly costs.

The Ohio Medicaid Assisted Living Waiver

For seniors with limited income and assets, the Medicaid Assisted Living Waiver (AL Waiver) is a lifeline. This Ohio program helps people who qualify for nursing home care receive support in a more home-like assisted living setting.

In Ohio, the AL Waiver pays for the care services on your bill—help with bathing, dressing, medications, etc. It does not cover the "rent," or the room and board portion of the cost.

A resident is still responsible for the monthly bill for their apartment and meals, typically paid using their Social Security or other income. To qualify, a person must meet strict financial and medical criteria set by the state. You can learn more in our guide to the Ohio Medicaid Assisted Living Waiver.

Example: A Cuyahoga County family using the AL Waiver…

A family in Parma is helping their mom. Her only income is $1,800/month from Social Security, and she has less than $2,000 in savings, so she meets the financial test. The Area Agency on Aging confirms she needs enough hands-on help to qualify medically.

Once approved, she moves into an assisted living community that accepts the waiver. The AL Waiver pays the community directly for her care services. Her $1,800 Social Security check is then used to pay for her room and board, making an otherwise out-of-reach option affordable.

Using Long-Term Care Insurance

If your loved one bought a long-term care (LTC) insurance policy, this is the situation it was designed for. These are private plans that cover services like assisted living. You'll need to review the policy for key details:

-

Elimination Period: A waiting period (often 30, 60, or 90 days) after qualifying for care before the policy starts paying. You'll pay out-of-pocket during this time.

-

Daily Benefit Amount: The maximum amount the policy will pay per day (e.g., $150 per day).

-

Benefit Triggers: The conditions that activate coverage, usually the inability to perform a certain number of ADLs.

Call the insurance company early to start the claims process.

VA Benefits for Veterans

Veterans and their surviving spouses may be eligible for the Aid and Attendance pension benefit. This is a tax-free monthly payment added to an existing VA pension. To qualify, a veteran must meet service requirements, have a documented medical need for daily assistance, and fall within income and asset limits. The money is flexible and can be used for any care-related expenses. Contact your local county Veterans Service Officer for free help with the application.

Comparing Ohio Assisted Living Payment Options

| Payment Source | What It Covers | Who It's For | How to Apply in Ohio |

| :------------------------ | :------------------------------------------------------------------- | :-------------------------------------------------------------------------- | :------------------------------------------------------------------------- |

| Private Pay | All costs, including room, board, and care. | Individuals with sufficient personal savings, retirement funds, or income. | Work directly with the community; no external application needed. |

| Medicaid AL Waiver | The care services portion only. Resident pays for room and board. | Low-income seniors with limited assets who meet a nursing home level of care. | Apply through your local Area Agency on Aging or County Job and Family Services. |

| Long-Term Care Insurance | Varies by policy, but typically a daily amount for care services. | Individuals who purchased a private LTC policy years in advance. | Contact the insurance company directly to initiate a claim. |

| VA Aid & Attendance | Provides a monthly stipend for any care-related costs. | Wartime veterans (or surviving spouses) with a medical need and limited finances. | Contact your county Veterans Service Officer or apply through the VA. |

Comparing the Value of Assisted Living to Other Care

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/lZGSRZKGuOA" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>When you see a monthly bill over $5,000, it's normal to wonder if it's the best choice. But that number doesn't tell the whole story. The value of assisted living becomes clear when you compare it to in-home care and skilled nursing facilities. It bundles housing, meals, social activities, and professional care into a single, predictable payment.

Assisted Living vs. In-Home Care

Hiring a home health aide seems simple, but costs can spiral. In the Cleveland area, an aide charges $28 to $35 per hour.

-

8 hours of care per day at $30/hour is $240 a day, or about $7,200 a month.

-

24/7 care could easily exceed $15,000 per month.

These figures don't include the costs of running a house—mortgage, taxes, utilities, repairs, and groceries. The all-inclusive nature of assisted living often proves to be more affordable and less stressful.

Assisted Living vs. Skilled Nursing Facilities

It's critical to know the difference between an Assisted Living (in Ohio, a Residential Care Facility) and a Skilled Nursing Facility (SNF), or nursing home. In Ohio, assisted living is state-licensed, while nursing homes are federally regulated by the Centers for Medicare & Medicaid Services (CMS). This reflects their different purposes.

| Feature | Assisted Living | Skilled Nursing Facility (Nursing Home) |

| :-------------------- | :---------------------------------------------------------------------------- | :-------------------------------------------------------------------------- |

| Primary Focus | A social model focused on independence. | A medical model providing 24/7 skilled nursing care. |

| Environment | Home-like, with private apartments and community spaces. | Hospital-like, often with semi-private rooms in a clinical setting. |

| Typical Resident | Needs help with daily tasks like bathing or medication reminders. | Has complex medical conditions requiring constant nursing oversight. |

| Ohio Cost | Around $5,500/month (Greater Cleveland) | $8,500-$9,500+/month or more |

What this means for you: Assisted living is a vital bridge. By providing support before a health crisis, it can often delay—or prevent—a move to a more intensive and expensive skilled nursing facility.

Nationwide, the average annual cost for assisted living in 2025 is projected at $64,200. This is a practical middle ground between independent living and a nursing home, which can cost over $111,325 per year for a semi-private room. The true value is peace of mind, knowing your loved one is safe, socially connected, and cared for. You can explore more assisted living facts and figures to see national trends.

What to Do Next: Your Cleveland Assisted Living Checklist

Alt Text: An illustrated checklist for assisted living planning. The checklist includes items like "Gather Documents," "Explore Waiver," "Tour 2-3 Communities," and "Talk to Ombudsman." A calm-looking family of three stands beside it.

Understanding the numbers is the first step. Now, it's time for action. Here is a simple plan to help you confidently find affordable, quality care in Northeast Ohio.

-

Gather Documents: Before you tour, collect essential financial and medical paperwork. This includes income/asset statements, diagnoses, medication lists, and doctor contacts. Having this file ready will make every conversation more productive.

-

Check AL Waiver Eligibility: If you think Medicaid might be an option, your first stop is the Ohio Department of Aging's website. Review the income and asset rules to see if it's a realistic path.

-

Tour at Least 2-3 Communities: There's no substitute for seeing a place yourself. Schedule tours and go with a list of questions about base rates, care levels, and one-time fees. Ask to see their latest state inspection report.

-

Talk to the Local Ombudsman: The Long-Term Care Ombudsman is your free, confidential advocate. Before signing anything, contact the Ombudsman for Northeast Ohio. They can offer unbiased insight into a community's history and help you understand your rights.

-

Get a Personalized List: Working with a local expert can save time and stress. Consider using a service that provides free, personalized recommendations based on your specific needs and budget.

This journey is a marathon, not a sprint. It’s okay to ask for help from services like senior living placement services that offer families free, personalized support.

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or medical advice. Please consult with licensed professionals for guidance on your specific situation.

Frequently Asked Questions About Assisted Living Costs

Does Medicare Pay for Assisted Living in Ohio?

No. In Ohio, Medicare does not pay for assisted living. Medicare is health insurance for doctors or short-term rehab after a hospital stay. It doesn’t cover long-term, non-medical "custodial care" like help with bathing, dressing, and meals. These costs must be paid for in other ways.

How Do I Find Out if My Parent Qualifies for the Ohio AL Waiver?

The best place to start is your local Area Agency on Aging (AAA). They are the experts who can walk you through the process. For families in Cuyahoga, Geauga, Lake, Lorain, or Medina county, your resource is the Western Reserve Area Agency on Aging website. Their team offers free consultations to help you navigate the financial and medical screening.

What Are Community Fees and Can They Be Negotiated?

A community fee is a one-time, upfront charge that covers administrative setup and apartment preparation. It never hurts to ask if the community is running any move-in specials that could reduce or waive the fee, especially depending on the time of year or their current occupancy.

Will the Monthly Cost Increase After We Move In?

Almost certainly, yes. You can expect annual rate increases of around 3-5% to keep up with inflation. Additionally, if your parent’s needs change and they require more hands-on help, their level-of-care fee will increase. Ask about a community's rate-increase history and if they offer any "rate-lock" options.

Trying to find the right community at the right price can feel completely overwhelming. The local advisors at Guide for Seniors live and breathe this stuff, and we’re here to help you navigate the process at no cost. We offer personalized recommendations, break down the costs, and set up tours so you can find the perfect fit. Get started with a free, personalized list of communities today.

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.