Does Medicare Cover Nursing Home Care in Cleveland Ohio? Here's the Truth.

-

The short answer: No, Medicare does not pay for long-term nursing home care. This is the #1 most expensive myth families in Cleveland face.

-

What Medicare does cover: A short-term stay (up to 100 days, but rarely) in a skilled nursing facility for rehab after a qualifying 3-day inpatient hospital stay.

-

The critical difference: Medicare covers medical skilled care (like physical therapy) but not non-medical custodial care (like help with bathing or dressing).

-

What happens after Medicare stops: You are responsible for 100% of the cost, which means you'll need a plan using private savings, long-term care insurance, or Ohio Medicaid.

Who This Guide Is For (and Why Doing It Alone Is So Hard)

If you're a family in Greater Cleveland (from Cuyahoga and Lorain to Lake, Geauga, Medina, or Summit counties), you're likely feeling overwhelmed. You're sorting through brochures that all look the same, fielding calls from facility marketers, and you're terrified of making a costly mistake.

This guide isn't just more information—it's your "insider" playbook. We're here to translate the marketing fluff into reality and help you move from endless research to a clear, confident decision.

The absolute most important thing to grasp is the difference between two types of care someone can receive in a nursing facility, because Medicare only pays for one.

Skilled Care vs. Custodial Care

Medicare will only step in to help pay for something called Skilled Nursing Facility (SNF) care. This is a specific, medical level of care that can only be provided by licensed professionals—think a registered nurse managing a complex wound or a physical therapist helping your dad learn to walk again after a fall near University Circle.

On the other hand, Medicare does not pay for custodial care. This is the non-medical, hands-on help with daily life like bathing, getting dressed, or medication reminders. This distinction is the critical piece of the puzzle. While brochures highlight the chandeliers, you need to know who will be paying for the day-to-day help your loved one actually needs.

Medicare Coverage At a Glance: Skilled Care vs Custodial Care

This table breaks down the two main types of nursing home care to show what Medicare may cover versus what it typically does not, helping Cleveland families understand the crucial difference.

| Care Type | What It Is | Does Medicare Cover It? | Example |

| :--- | :--- | :--- | :--- |

| Skilled Care | Medically necessary care that must be performed by a licensed professional (e.g., nurse, therapist). | Yes, but only for a limited time and with strict rules. | A physical therapist helping a patient regain mobility after a hip replacement at The Clinic. |

| Custodial Care | Non-medical assistance with Activities of Daily Living (ADLs) like bathing, eating, and dressing. | No, Medicare does not cover this type of long-term care. | An aide helping a resident with dementia get dressed in the morning. |

As you can see, the type of care your loved one needs is the deciding factor for whether Medicare will contribute at all.

The Fine Print: How to Qualify for Medicare’s Limited Coverage

Even if your family member needs skilled care, getting Medicare to pay for it involves clearing some very specific hurdles.

First, your loved one must have a qualifying inpatient hospital stay of at least three consecutive days—and the day of discharge doesn’t count. This "three-day rule" is non-negotiable. After that hospital stay, a doctor must certify that they need daily skilled care in a SNF for the same condition they were treated for in the hospital. If you'd like to dive deeper into the federal guidelines, you can review the official MedPAC reports for a detailed breakdown.

Once they qualify, here’s how the coverage timeline works:

-

Days 1–20: Medicare Part A covers 100% of the cost.

-

Days 21–100: You become responsible for a significant daily coinsurance payment.

-

After Day 100: Medicare stops paying completely. You are now responsible for 100% of the cost.

That final point is a tough reality. After 100 days, the full—and often staggering—financial responsibility shifts entirely to your family.

How Medicare's Skilled Nursing Benefit Actually Works

When a discharge planner at a Cleveland-area hospital mentions moving a loved one to "rehab," the conversation about how Medicare pays can feel like a blur—especially when you’re already stressed. Let's break down the official rules and translate them into what they actually mean for your family.

The whole system boils down to a couple of strict, non-negotiable requirements.

First up is the qualifying 3-day hospital stay. This is a major gatekeeper. Your loved one must be formally admitted to the hospital as an inpatient for at least three consecutive days. The day of discharge doesn't count. It's a critical detail that many families miss: time spent in the emergency room or under "observation status" doesn't count toward this 3-day rule. It's a costly distinction.

Once that first hurdle is cleared, a doctor has to certify that the patient needs daily skilled care—think intensive physical therapy or complex wound management—directly related to the reason for their hospital stay. If both of those boxes are checked, Medicare Part A can finally step in to help cover the costs at a skilled nursing facility.

The 100-Day Coverage Clock

Now, let's talk about the timeline. While Medicare offers up to 100 days of coverage, it's absolutely crucial to understand that those 100 days are not guaranteed. It's a common and expensive misconception.

Coverage only continues as long as the patient requires daily skilled medical services and is making measurable progress. The second their care needs transition to mostly custodial help (like assistance with bathing or dressing), Medicare coverage stops. It doesn’t matter if it’s day 18 or day 80. The clock stops when the need for skilled care ends.

Here’s how the payment schedule typically works during a single benefit period:

-

Days 1–20: Medicare covers 100% of approved costs.

-

Days 21–100: You pay a daily coinsurance. For 2024, this is $204 per day.

-

After Day 100: You're on your own. You are responsible for 100% of the cost.

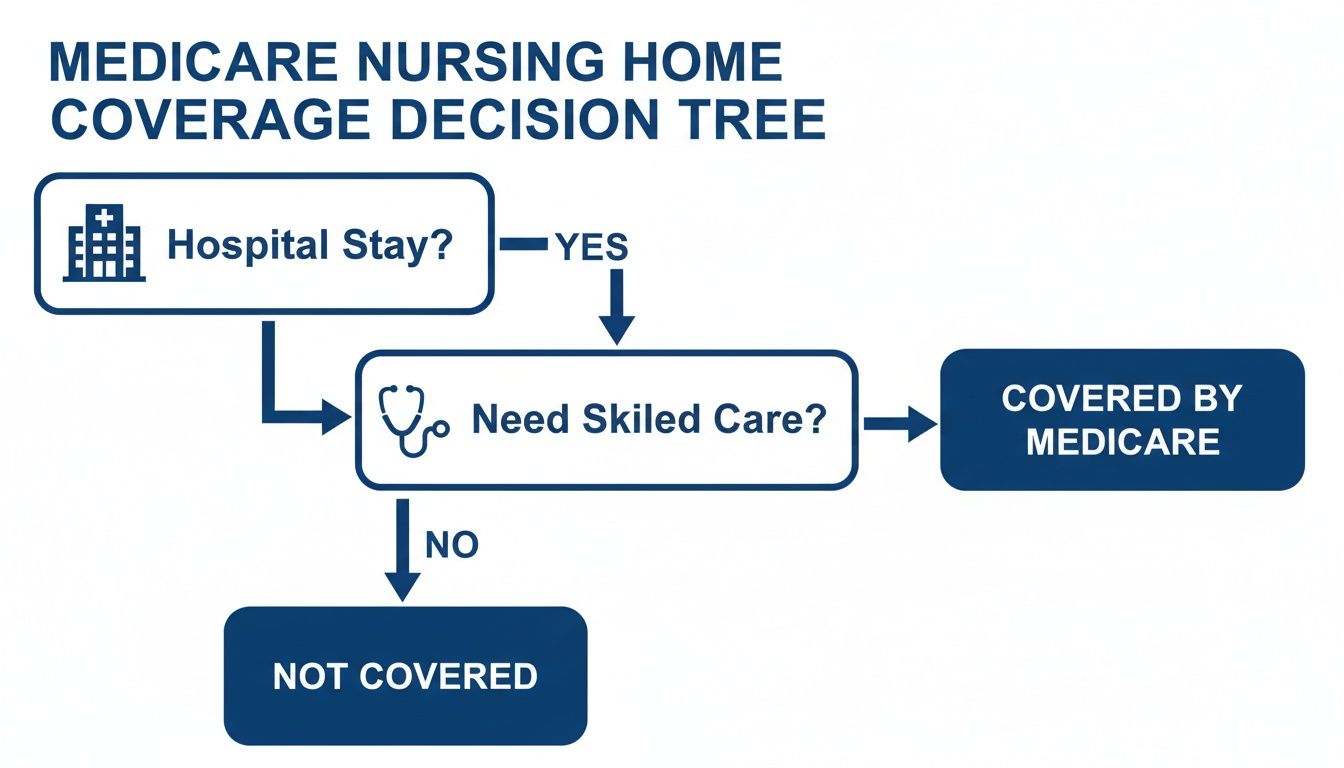

This simple decision tree illustrates the two essential questions that determine whether Medicare will pay for a nursing home stay.

As you can see, without both the qualifying hospital stay and the documented need for daily skilled care, Medicare simply won't pay. The financial reality of that can be a shock.

To put it into perspective for 2024, after you meet the Part A deductible ($1,632), Medicare covers those first 20 days fully. But from day 21 on, that $204 daily copay kicks in. Once that 100-day window closes, or if skilled care is no longer needed, families must pivot to other payment sources like Medicaid or private funds. If you want to dive deeper into the specific services covered, check out our guide on what is skilled nursing care.

Questions to Ask the Hospital Discharge Planner

Before your family member leaves Cleveland Clinic, University Hospitals (UH), or another local hospital, you need to get crystal-clear answers. Use this checklist to arm yourself with the right information and avoid any devastating financial surprises.

-

Has Mom or Dad been officially admitted as an "inpatient," or are they here under "observation status"?

-

How many qualifying inpatient days have they accumulated so far?

-

What specific skilled care does their doctor say they need every day?

-

How long does the medical team realistically expect they will need this daily skilled care?

-

Which local skilled nursing facilities are in their Medicare network and actually have a bed available right now?

What Happens When Medicare Stops Paying?

This is the moment many families in Greater Cleveland dread. The limited window for Medicare-covered skilled care closes, and suddenly, the full financial responsibility for long-term care lands squarely on your shoulders.

It’s a jarring transition, but understanding what comes next is the first step toward building a sustainable plan. The big question becomes: how will we cover the ongoing costs of custodial care? For most Ohio families, the answer lies in personal savings, specific insurance policies, or government programs built for long-term support. The key is knowing which path to take before the bills start piling up.

Understanding Your Primary Funding Options

Once you're facing private pay rates, you need to get a handle on your financial resources—and fast. This isn’t just about writing a check each month; it’s about creating a long-term strategy.

-

Private Pay (Self-Funding): This is exactly what it sounds like—using personal assets like savings, investments, or income from pensions and Social Security. It gives you the most freedom to choose a facility, but it can drain a lifetime of savings with shocking speed.

-

Long-Term Care Insurance: If your loved one was proactive and has a policy, now is the time to get it activated. These policies are designed specifically for custodial care, but they come with their own rules, like elimination periods (a deductible you pay in days, not dollars) and daily benefit caps.

-

Veterans (VA) Benefits: Don’t overlook this. For eligible veterans and their surviving spouses, programs like Aid & Attendance can provide a critical monthly payment to help with care costs. It’s a powerful benefit that many families don't even know exists.

-

Ohio Medicaid: For many, this is the ultimate safety net. However, qualifying is tough. In Ohio, eligibility is based on strict financial limits on both income and assets, often forcing families to "spend down" their resources just to get help.

The Reality of Medicaid and "Spending Down"

In Ohio, Medicaid is the single largest payer for long-term nursing home care, but it’s a needs-based program. To qualify, an individual must have very few assets—often just a couple thousand dollars, not counting a primary home under specific circumstances.

This reality leads to a process known as "spend down," where a person strategically uses their money on legitimate care expenses until they meet Medicaid's low asset threshold. This has to be done by the book. Simply giving away money to your kids can trigger a penalty period, locking you out of Medicaid eligibility for months or even years. For a deeper dive, you can explore the differences in our Medicare vs. Medicaid Ohio guide.

Cleveland Scenario: A Costly Assumption in Parma

A Parma family felt a wave of relief when Medicare covered their mom's rehab after a hospital stay. They just assumed this coverage would continue as her needs became more long-term. But after only 20 days, her care was reclassified as "custodial," and Medicare coverage vanished overnight. They were suddenly hit with a bill for over $9,000 a month. The family spent the next few weeks scrambling, trying to navigate complex Medicaid rules and sell assets, all while their mom’s savings evaporated. A single conversation with an advisor beforehand would have given them a roadmap, saving them immense stress and thousands of dollars.

Don’t let this happen to your family. The rules are complicated, and one wrong move can be financially devastating. Instead of guessing, get a clear strategy.

Your Next Step: Pricing and funding options change constantly. Click here to get a current Rate Sheet for communities in your specific Cleveland neighborhood, or speak to a local Senior Advisor for free to create a personalized financial plan.

How Medicare Advantage Plans Change the Nursing Home Game

If you or your loved one has a Medicare Advantage plan (also known as Part C), you're playing by a different set of rules. This is a big deal for a lot of seniors here in Cuyahoga County. These plans are sold by private insurance companies, and while they have to cover at least what Original Medicare covers, they get to decide how.

That means they have their own provider networks, their own co-pays, and their own requirements for getting care approved beforehand. This is where things get tricky. A nursing home's brochure might proudly state they “accept Medicare,” but that phrase can be dangerously misleading. The real question is: are they in-network for your specific Advantage plan?

The In-Network Trap That Catches Cleveland Families

Getting this wrong can lead to staggering, out-of-the-blue medical bills. A top-rated plan that's popular on the East Side might have a fantastic network of facilities near University Circle, but offer almost no options for a skilled nursing stay over by Crocker Park. It's incredibly localized.

And just because a facility’s marketing materials show it’s a stone's throw from The Clinic doesn't mean your Advantage plan actually has a contract with them. Assuming they do is one of the most expensive mistakes a family can make, especially during the chaos of a hospital discharge.

Insider Tip: Treat the phrase "we take Medicare" as a marketing slogan, not a promise of coverage. You have to confirm that the facility is an approved, in-network provider with your specific Medicare Advantage plan before your loved one is even transferred. An out-of-network stay could leave you responsible for 100% of the bill.

A Growing Concern Across Northeast Ohio

More and more seniors are opting for these plans. As of 2023, a surprising 38% of long-stay nursing home residents were enrolled in a Medicare Advantage plan. This trend is important because these private plans can and do limit your choice of skilled nursing facilities and change how much they pay for care, creating a maze that’s nearly impossible to get through on your own. You can read more about this trend and its impact on skillednursingnews.com.

Instead of burning hours on hold with your insurance company, trying to decipher confusing provider lists, let an expert do the heavy lifting. Confirming your plan’s network is the most critical step you can take.

Don't leave it to chance when thousands of dollars are at stake. A quick, free call to a Cleveland-based Senior Advisor can get you a verified list of in-network facilities that match your loved one’s care needs and, just as importantly, have a bed available right now.

The True Cost of Nursing Home Care in Cleveland

When you start researching care options, you’ll find plenty of national statistics online. But those vague numbers won't help you budget for a loved one here in Medina, Lorain, or anywhere else in Greater Cleveland. To get a real handle on the financial road ahead, you need concrete, local figures.

The reality is, the costs are steep. They can burn through a lifetime of savings in a shockingly short amount of time if you aren't prepared. Facility brochures might show off beautiful dining rooms near University Circle or Crocker Park, but they rarely put the full price tag on the front page. That’s why getting unbiased, local data is so important.

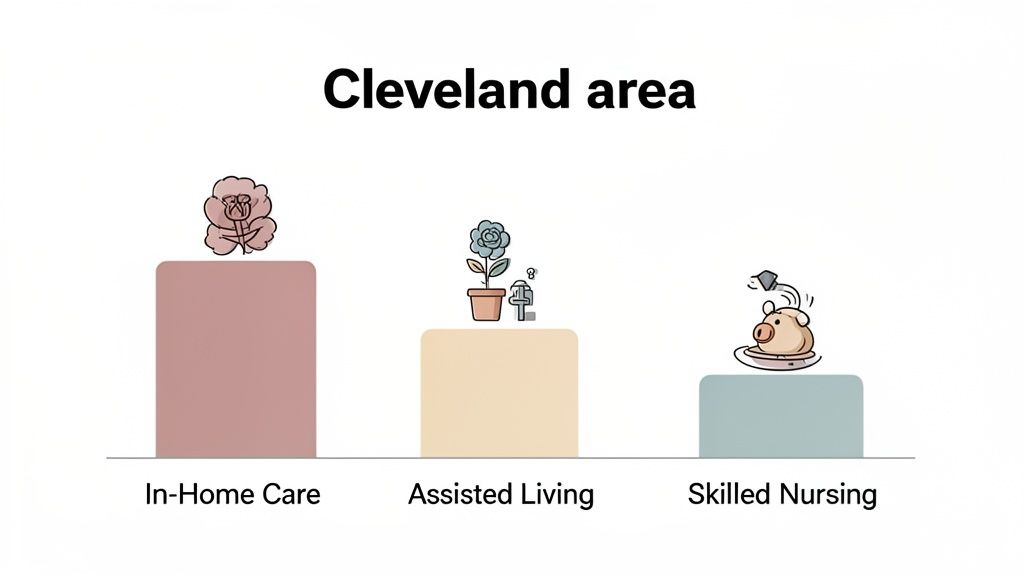

To give you a clearer financial picture, we've pulled together the typical costs for different levels of senior care across the Cleveland-Elyria-Mentor metro area. This helps put skilled nursing costs into perspective against other common options.

Estimated Monthly Senior Care Costs in Greater Cleveland

Here’s a comparison of what families can generally expect to pay each month. Remember, these are estimates, and prices will vary from one community to the next.

| Type of Care | Average Monthly Cost (Updated: June 2024) | Who It's Best For |

| :--- | :--- | :--- |

| In-Home Care | $5,500 - $6,500 | Seniors who want to stay at home but need help with daily living and personal care. |

| Assisted Living | $4,500 - $7,000+ | Seniors who need some daily support but don't require 24/7 medical supervision. |

| Skilled Nursing | $8,500 - $10,000+ | Seniors with complex medical conditions who need round-the-clock care from licensed nurses. |

These estimates are based on state-sourced data. The final cost will depend on the community, room type, and the specific level of care needed.

This table shows just how different the financial commitment is for each type of care, underscoring why understanding Medicare's specific rules for skilled nursing is so critical for families.

The Hidden Costs Beyond the Sticker Price

It’s absolutely crucial to know that the "base rent" is just the beginning.

Most communities tack on "level of care" fees, which are calculated based on how much hands-on help a resident needs. These fees are almost never fixed and can climb as your loved one's needs increase.

This is where so many families get caught off guard. A facility might quote a price that seems manageable, but once you add in care charges, medication management fees, and other extras, the final bill can be thousands higher. Figuring out how to navigate this is a key part of our guide on protecting assets from nursing home costs.

Insider Tip: Many communities charge a one-time "Community Fee" when you move in, often several thousand dollars. This fee is frequently negotiable, especially if a facility has a few open rooms. A good Senior Advisor knows which communities have more flexibility and can help you ask the right questions.

Instead of trying to piece all this together from a dozen different websites and confusing phone calls, let us give you the clear, current information you need.

Your Next Step: Pricing and availability change daily. Click here to get a current Rate Sheet for communities in your target neighborhood or speak to a Cleveland-based Senior Advisor for free.

Your Action Plan for Making a Nursing Home Decision

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/0Ah6PEKdCfM" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>It’s completely normal to feel overwhelmed right now. We've just walked through a ton of complex information about what Medicare does—and doesn't—cover when it comes to nursing home care. Now, let’s turn all that information into a clear, focused plan.

Instead of getting lost in a dozen confusing websites, here are the three direct steps you need to take. This is how you move from just researching to finding a real solution.

Your Three-Step Plan

-

Confirm the Exact Level of Care Needed. This is the most important first step. Do you need short-term skilled care after a hospital stay, or are you looking at long-term custodial care? This single answer changes everything about how you will pay for it.

-

Verify Every Single Insurance Benefit. It's time to pull out the actual cards and policy documents for Original Medicare, a Medicare Advantage Plan, or any long-term care insurance you might have. An advisor can help you cut through the jargon to understand what each one really covers and which facilities are in-network.

-

Map Out Your Funding Pathways. You need a clear and honest picture of your budget. This means looking at private funds, figuring out eligibility for VA benefits, and understanding the very specific rules for qualifying for Ohio Medicaid.

Don't Go It Alone: Trying to manage this process by yourself is draining. Imagine spending days calling facilities all over Solon or Westlake just to check on pricing and availability. A Senior Advisor can get you a current, verified list in a single, stress-free conversation. Your next step is clear—stop researching and start consulting.

Don't guess your way through this. Speak to a Cleveland-based Senior Advisor for free and create a personalized action plan that works for your family.

Common Questions We Hear from Cleveland Families

When you're trying to figure out how Medicare fits into the nursing home puzzle, a lot of questions pop up. Here are the straight-up answers to the ones we get asked most often.

Will My Medigap Plan Pay for Long-Term Nursing Home Stays?

In a word, no. Think of Medigap as a sidekick to Original Medicare—it helps pay for the things Medicare already covers, but it doesn't add new benefits.

This means your Medigap policy can be a huge help with that daily coinsurance for skilled nursing care from days 21-100. But since Original Medicare draws a hard line and won't pay for long-term custodial care, your Medigap plan won't either.

What's the Real Difference Between a Medicare-Certified and a Medicaid-Certified Facility?

This is one of the most important distinctions to understand when you start your search, and getting it wrong can cause major headaches.

A Medicare-certified facility is what we call a Skilled Nursing Facility (SNF). It's been given the green light by Medicare to provide that short-term, intensive medical care and rehab we talked about earlier. This is for recovery, not a permanent stay.

A Medicaid-certified facility, on the other hand, is approved to provide long-term custodial care for residents who meet Ohio's specific financial requirements. Many nursing homes are certified for both, but you absolutely have to ask and confirm this upfront.

A family in Solon spent three weeks touring facilities, only to find out their top choice didn't accept the AL Waiver. A quick check with a local advisor would have saved them that time.

Can We Hire a Private Aide for Extra Help in the Nursing Home and Bill it to Medicare?

Unfortunately, no. Medicare will not pay for any private-duty nurses or personal aides you hire to assist a loved one in a facility.

The care that Medicare covers is provided exclusively by the facility's own staff. If you feel your family member needs extra one-on-one attention and decide to hire someone privately, that cost will come directly out of your own pocket.

How Does the Ohio Medicaid Assisted Living Waiver Actually Work?

The Ohio Medicaid Assisted Living Waiver, often just called the AL Waiver, is a fantastic state program. It's designed to help financially eligible seniors pay for care in an assisted living community, which can be a great alternative to a nursing home.

However, navigating the eligibility rules is tricky, and many of the best communities have long waitlists. Working with an advisor can help you quickly pinpoint Cleveland-area communities that not only accept the waiver but also have openings right now.

Trying to piece all of this together on your own is overwhelming. You don't have to guess your way through it. The local experts at Guide for Seniors can give you a clear, simple path forward.

Click here to speak with a Cleveland-based Senior Advisor for free to narrow your list.

Need Help Finding Senior Living?

Our local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.