Memory Care Cost Comparison in Cuyahoga vs. Lake County: Your Insider's Guide

Trying to find the right memory care in Northeast Ohio can feel like navigating a maze blindfolded. You're drowning in glossy brochures and vague sales pitches, terrified of making a costly mistake for someone you love. This guide is for you. We're not here to give you more brochures; we're here to be your "insider," translating the marketing fluff into the reality you need to make a confident decision.

-

The Bottom Line: Memory care in Cuyahoga County is generally more affordable than in Lake County, often by over $335 per month.

-

Why the Difference? Greater competition and lower real estate costs in Cuyahoga County drive down prices.

-

What Really Matters: The advertised price is just the start. "Level of Care" fees, staffing ratios, and specialized training are the true drivers of cost and quality.

-

The "Villain" is Confusion: Trying to do this alone is overwhelming. The goal is to move from endless research to a clear, actionable plan with an expert guide.

Your Quick Guide to Memory Care Costs: Cuyahoga vs. Lake County

For families across Greater Cleveland, from the East Side to the West Side, the financial piece of this puzzle is enormous. The data reveals a significant price gap between these two neighboring counties that can impact your budget for years to come.

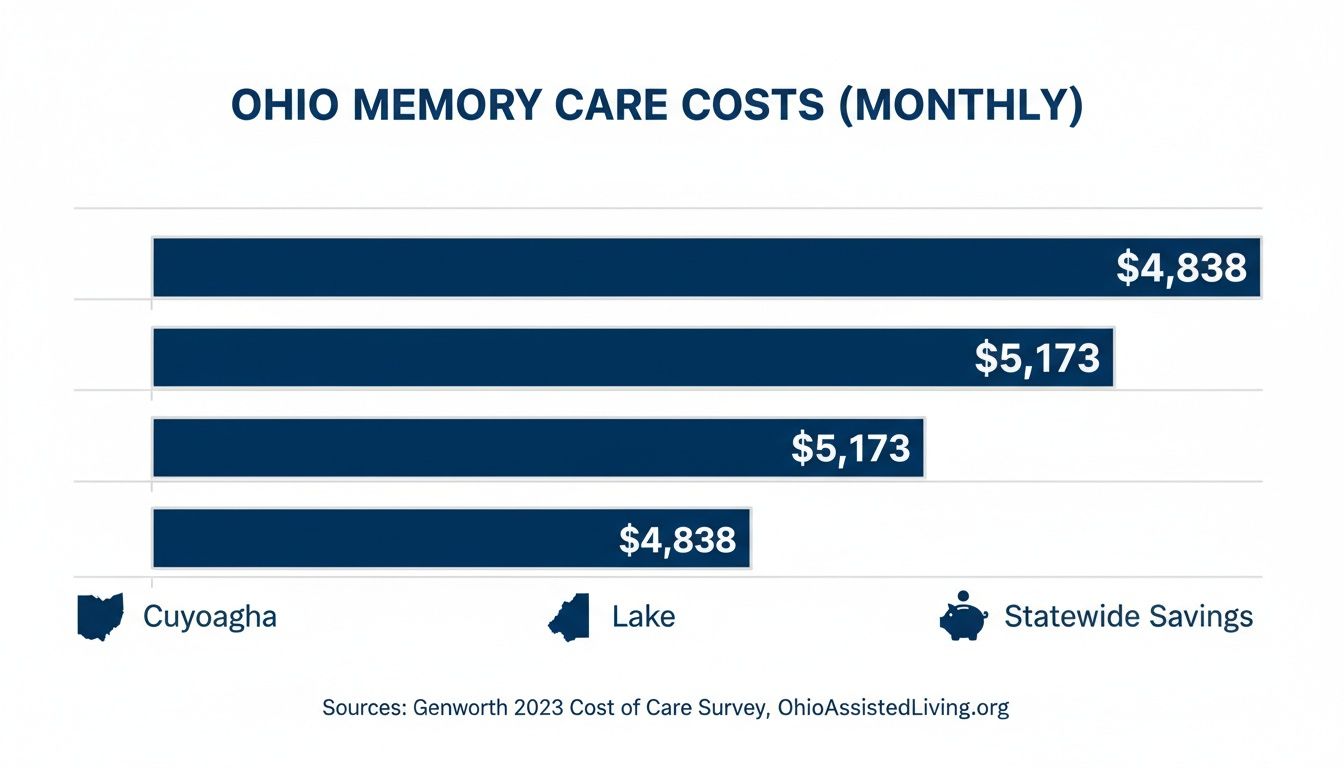

As of October 2024, the median monthly cost for memory care in Cuyahoga County hovers around $4,838, which is actually below the Ohio state average. Head east into Lake County, and that figure climbs to an average of $5,173 per month—a premium of over 7%.

What does that look like over a full year? It can add up to $4,032 in savings for a family who opts for a community in Cuyahoga County. This isn't a small difference.

This chart puts that monthly cost difference into perspective.

While these state-sourced numbers are a great starting point, they only tell part of the story. You can learn more about how much memory care costs in our detailed guide.

At-A-Glance Memory Care Cost Cuyahoga vs Lake County

This table breaks down the key differences you’ll want to consider when weighing options. It’s a quick summary to help you focus on what really matters.

| Metric | Cuyahoga County | Lake County | The Insider Take |

| :--- | :--- | :--- | :--- |

| Median Monthly Cost | ~$4,838 | ~$5,173 | The $335+ monthly savings in Cuyahoga is driven by a higher number of communities and more competition. (State-Sourced Data, Updated: October 2024) |

| Community Density | High | Moderate | More choices in Cuyahoga can give families more negotiating power on things like one-time community fees. |

| Ohio Medicaid Waiver | Many participating communities | Fewer participating communities | In Ohio, families planning to use the Medicaid Assisted Living Waiver (AL Waiver) often have more options in Cuyahoga County. |

| Proximity to Hospitals | High (The Clinic, UH) | Moderate (UH, Lake Health) | For many families, direct access to specialists at University Circle is a non-negotiable factor. |

Ultimately, while cost is a major driver, it's just one piece of the puzzle. The best fit depends on your family's specific needs—from medical care access to the kind of community environment that will feel like home.

Why Memory Care Prices Differ So Much Between Counties

It’s completely normal to feel a bit of sticker shock. You might see a price tag in Cuyahoga County and then find a community just a few miles east in Lake County that costs hundreds more per month. It’s easy to wonder, "What am I actually paying for?"

The truth is, it's never just one thing. The final cost is a blend of local economics, the true level of staffing, and what "care" really means behind the brochure photos.

This isn't about one county being "better." It's about understanding the key factors that drive the price so you can make a truly informed decision for your family.

The Role of Real Estate and Competition

One of the biggest hidden costs is the very ground the building sits on. Real estate values and property taxes in suburbs like Mentor or Willoughby are simply different from denser areas like Lakewood or Parma. Those operational expenses inevitably get passed on to residents.

There's also the simple matter of supply and demand. Cuyahoga County has a significantly higher number of memory care communities. This creates a more competitive marketplace. When facilities have to work harder to attract residents, it can put downward pressure on base rent and often leads to more attractive move-in deals.

Insider Tip: The 'Community Fee' is often negotiable. More competition gives you more leverage. A community in a crowded area like the West Side suburbs might be open to negotiating this one-time fee. A facility with a long waiting list in a less competitive part of Lake County will have much less incentive. Ask your advisor how to approach this conversation.

Beyond the Brochure: What "Amenities" Really Mean

While brochures highlight the chandeliers, you need to ask about the weekend staffing ratios. The features that truly impact quality of life for someone with dementia are often invisible. This is where you have to dig deeper.

Here are the questions that cut through the marketing fluff:

-

Staffing Ratios: A place might advertise "24/7 care," but that's a given. The real question is, what is the staff-to-resident ratio during the day? What about overnight or on the weekends when management isn't there?

-

Specialized Training: Ask what specific dementia care training the staff has. Programs like Teepa Snow’s Positive Approach® to Care or having Certified Dementia Practitioners (CDPs) on staff go far beyond basic state requirements required by the Ohio Department of Health (ODH). This is an investment in safety and quality of life.

-

Dining and Nutrition: One community’s "chef-prepared meals" could mean a standard, rotating menu. Another's might mean they have a registered dietitian on staff creating therapeutic diets for residents with complex needs like swallowing difficulties (dysphagia).

A Tale of Two Families

Let's look at a common scenario. A family from Solon is touring two communities. Community A, in Cuyahoga County, costs $5,200 a month. Community B, just over the line in Lake County, costs $5,600. On paper, the cheaper option seems like a no-brainer.

But here’s what they learned after digging deeper with an advisor. The higher price at Community B included a dedicated, on-site physical therapy team and a higher staffing ratio on the night shift. For their father, who was a significant fall risk and prone to sundowning, these two things were critical.

That extra $400 a month wasn't for a nicer lobby; it was buying them peace of mind.

This is exactly why a simple cost-per-month comparison is never enough. You have to compare the value you get for that cost, and that's nearly impossible to do from a website alone. The key is to match your loved one’s specific care needs to what a community actually delivers, not just what it advertises.

Decoding The Bill: What Does "All-Inclusive" Really Mean?

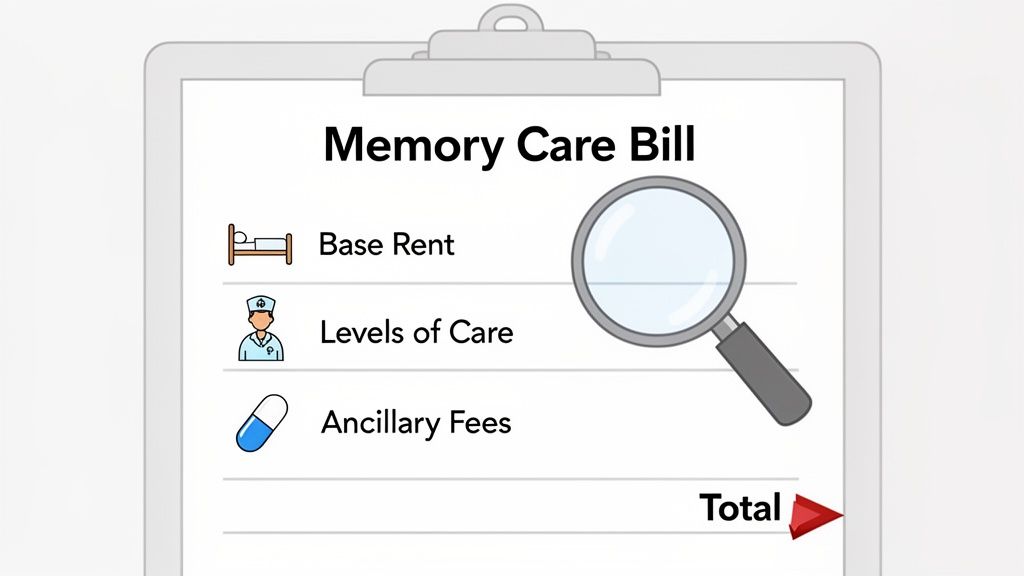

One of the most common frustrations families face is the sticker shock when the first bill arrives. You're given a quote that seems straightforward, but the final monthly total is often much higher. The term "all-inclusive" is a marketing phrase, not a guarantee.

To accurately compare memory care costs, you have to look past the advertised price. Your bill is made up of two distinct parts: the Base Rent and the Level of Care fees. Getting this wrong is the fastest way to derail your budget.

Base Rent vs. Level Of Care Fees

Think of the Base Rent as the "real estate" portion of the cost. This covers the apartment, three meals a day, utilities, basic housekeeping, and access to shared amenities. It’s the most predictable part of your monthly payment.

The Level of Care (LOC) fee is where things get complicated. This is the additional charge for the actual, hands-on care your loved one receives. In Ohio, communities (known as Residential Care Facilities or RCFs) determine this fee by assessing how much help a person needs with their Activities of Daily Living (ADLs).

The more support someone requires, the higher their LOC fee will be.

-

Bathing and Showering

-

Dressing

-

Eating

-

Toileting and Continence Care

-

Transferring (moving from bed to chair, etc.)

Before move-in, a community nurse will perform an assessment to set the initial LOC. It's important to know that these assessments are done periodically. As a resident's needs change, that LOC fee is almost certain to increase.

Uncovering The Ancillary Charges

On top of those two main costs, nearly every community has a list of ancillary charges—smaller fees that can nickel and dime you. These are almost never advertised on the main price sheet.

Insider Tip: The one-time "Community Fee" or "Move-In Fee" can run from $1,500 to over $5,000. Don't be afraid to ask if they can lower or waive it, especially if you know the community has a few open apartments. A Senior Advisor can give you a good sense of which communities are more willing to negotiate.

Some common extra fees to watch for include:

-

Medication Management: A separate monthly fee for staff to manage prescriptions. This alone can add $300 to $700 per month.

-

Incontinence Supplies: Most communities will bill you for these separately.

-

Transportation: Personal trips to appointments at The Clinic or UH will likely have a per-trip or mileage fee.

-

Specialized Diets: If your loved one needs a specific therapeutic diet, expect an upcharge.

These extra charges are exactly why you can't rely on the initial quote. Historical data from sources like the Lake County senior services report appendices shows how these costs consistently rise. You can learn even more by exploring the common hidden costs of assisted living. You don't have to decipher these complex fee structures by yourself.

Primary CTA: Pricing and availability change daily. Click here to get a current Rate Sheet for Cleveland-area communities.

How to Pay For Memory Care In Northeast Ohio

Figuring out the cost is one thing; figuring out how to pay for it is the challenge that keeps most families up at night. You’re not just managing a budget. You’re navigating a maze of private and public benefits, each with its own rulebook. The good news is, you have more options than just writing a check.

The reality is that most families piece together a funding strategy. It’s critical to understand these paths before you start touring, as it will immediately tell you which communities are truly viable.

Let's break down the three primary ways families in Northeast Ohio pay for memory care.

The Main Payment Options

-

Private Pay: The most common path. Families use personal funds from pensions, Social Security, savings, or the proceeds from selling a home.

-

VA Aid & Attendance: An often-overlooked benefit for wartime veterans and their surviving spouses. It provides a monthly pension to help cover long-term care costs.

-

Ohio Medicaid Assisted Living Waiver (AL Waiver): For those with limited income and assets, this statewide program helps cover the cost of care services in a memory care community. The resident typically pays for their room and board with their own income (like Social Security).

Navigating these options alone is tough, which is why we created a comprehensive guide on how to pay for memory care that dives into even more detail.

Understanding The Ohio Medicaid AL Waiver

The Medicaid Assisted Living Waiver (AL Waiver) is a critical resource, but it comes with strict eligibility rules set by the state of Ohio. To qualify, an individual must meet both medical and financial requirements.

Medically, they must need a nursing home level of care. Financially, their income and assets must fall below a certain threshold. As of 2024, this generally means an income below $2,829 per month and countable assets under $2,000 for an individual. These numbers can change, so always verify the current limits with the Ohio Department of Aging.

The Cost of Inaction: A Solon Family's Story

A family in Solon spent three weeks touring facilities, only to find out their top choice didn't accept the AL Waiver. Their mother's funds were projected to last two years, after which she would need Medicaid. A quick check with a local advisor would have saved them that time and heartache.

County Costs and The Spend-Down Strategy

This is where the price difference between Cuyahoga and Lake County becomes critical. Many families "spend-down" assets to qualify for Medicaid. Because memory care in Cuyahoga County is generally less expensive, a person's private funds simply last longer. This extends the spend-down period, giving the family more breathing room. Choosing a community with a lower monthly rate in a place like Parma or Westlake can make a huge difference in how long private assets can sustain the cost of care.

Secondary CTA: Don't guess. Speak to a Cleveland-based Senior Advisor for free to narrow your list.

Your Action Plan: Making the Right Choice

It's easy to get buried in data and feel paralyzed. You've compared the costs between Cuyahoga and Lake County and deciphered the bills. Now it's time to shift from researcher to advocate. This is the moment you move beyond spreadsheets and start evaluating the real-world options.

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/N3Zo3fDEsUg" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Making the right choice boils down to asking the right questions. The beautiful lobbies don't tell you about the quality of care at 2 a.m. on a Sunday. When you tour, your goal is to pull back the curtain on what daily life is actually like for residents with dementia.

Questions That Go Beyond The Brochure

Come to a tour armed with a notebook. The way a community’s leadership answers—or deflects—will tell you everything you need to know.

The Essential Tour Checklist

Use this checklist to look past the decor and assess the real quality of care, staffing, and community life.

| Category | Questions to Ask During Your Tour | Why It Matters |

| :--- | :--- | :--- |

| Staffing & Training | What is your staff-to-resident ratio during the day, evening, and on weekends? | A low ratio means more personalized attention and faster response times, especially during off-peak hours. |

| Staffing & Training | What is your staff turnover rate over the last year? | High turnover is a major red flag. It can indicate poor management and lead to inconsistent care for residents who thrive on routine. |

| Staffing & Training | What specific dementia care training is required for all staff, including dining and housekeeping? | Look for programs beyond basic state requirements. This shows a real commitment to understanding memory care residents. |

| Care & Safety | How do you handle challenging behaviors like agitation or wandering? | A good community will have a clear, non-pharmacological approach first, focusing on redirection and understanding the cause. |

| Care & Safety | Can you describe your process for creating and updating individual care plans? | Care plans should be living documents, reviewed frequently with family input, not a file that's created once at move-in. |

| Community Life | Can I see an activity calendar specifically for memory care residents? | Look for structured, failure-free activities that happen seven days a week, not just Monday through Friday during business hours. |

By asking the same structured questions at each location, you can truly compare apples to apples.

From Research To Reassurance

Having a list of questions is a great start, but you first need to know which communities are worth visiting. Is it more important to be close to your home in Westlake, or is proximity to the neurological specialists at University Circle a bigger factor?

Insider Tip: Pricing and availability for memory care change daily. A community with a waiting list last week might have an unexpected opening tomorrow. The only way to know for sure is to get a current update from a team who tracks this information.

You can spend your weekend calling one community after another, asking about rates, openings, and if they accept the AL Waiver. Or, you can make one call to an expert who already has those answers. Our Cleveland-based Senior Advisors can verify current openings and provide up-to-date Rate Sheets, saving you from chasing down dead ends.

Stop Guessing. Start Planning With a Local Advisor.

You've looked at the numbers. But numbers on a page can't tell you what a community feels like or reveal the compassion of its staff. You've done the tough research; now it's time to get personalized, local guidance to make that final choice with confidence. You don't have to do this alone.

Our Cleveland-based Senior Advisors have walked the halls of these communities across Northeast Ohio. We know what's going on behind the glossy brochures—from the actual weekend staffing ratios to which places are truly equipped to handle complex dementia behaviors. This insider knowledge is what separates a good choice from the right choice.

Your Path To a Confident Decision

Our guidance comes at no cost to you. We're compensated by our partner communities, allowing us to provide unbiased, expert advice focused solely on your loved one’s well-being. This is about saving you precious time and preventing incredibly stressful, costly mistakes.

The Insider Advantage: We know which community near Crocker Park has an outstanding resident engagement program and which one in Mentor has deep experience with early-onset dementia. You’ll never find these critical details on a website, but they can make all the difference.

Stop spending your weekends calling around for a straight answer on pricing. Let us do the heavy lifting.

Ready for clarity? We have two simple, free ways to help you take the next step.

-

Primary Next Step: Pricing and availability can change in an instant. Click here to get a current Rate Sheet for communities in your target area.

-

Secondary Next Step: Don't leave this to chance. Speak to a Cleveland-based Senior Advisor for free to narrow your list and schedule tours.

Your Top Questions About Memory Care in Ohio

As you dig into this, you're bound to have more questions. Here are straightforward answers to the questions we hear most often from families in the Cleveland area.

Does Medicare Pay for Memory Care in Ohio?

This is the first question on everyone's mind, and the simple answer is, unfortunately, no. Traditional Medicare is designed for short-term, skilled medical care—like rehab after a hospitalization. It does not pay for the long-term room, board, and personal care that are the cornerstones of memory care. In Ohio, families rely on private savings, long-term care insurance, VA benefits, or the state's Medicaid AL Waiver.

What's the Real Difference Between Assisted Living and Memory Care?

On the surface, they can seem similar, but their purpose is worlds apart. Think of memory care as a highly specialized, secure neighborhood, often part of a larger assisted living community (which in Ohio is licensed as a Residential Care Facility or RCF).

-

Assisted Living (RCF) is for seniors who are largely independent but might need help with daily activities like medication management or meals.

-

Memory Care is built from the ground up for individuals with dementia. These units are secured to prevent wandering, staff have specialized training to respond to dementia-related behaviors, and the daily rhythm is structured to provide comfort and reduce agitation. This is distinct from a Skilled Nursing Facility (SNF), which provides 24/7 medical care.

How Long Does It Actually Take to Find Memory Care in the Cleveland Area?

This depends on your circumstances. A crisis situation might force a decision in days. For families who can plan, the process can take several weeks or months. It can feel like a full-time job.

The biggest time-waster we see is families spending weeks touring communities that were never a good fit—because of the cost, the level of care needed, or not having any openings. A local advisor can cut that search time by more than 75% by giving you a curated list of appropriate, available options right from the start.

This is where a local expert makes all the difference. We can drastically shorten your search by instantly matching you with communities that have current availability, accept your long-term funding source (like the AL Waiver), and are truly equipped to handle your loved one’s specific needs.

Disclaimer: This article is for informational purposes only and does not constitute medical or legal advice. Consult with a qualified professional for advice tailored to your situation.

Don't guess your way through one of life's most important decisions. The local experts at Guide for Seniors can provide a personalized, pre-screened list of the best memory care options in Cuyahoga, Lake, and surrounding counties—all at no cost to your family. Get your free, personalized recommendations today.

Find Medicaid-Approved Communities Near You

Looking for a facility that accepts the Ohio Medicaid Assisted Living Waiver? Browse communities in these Cleveland suburbs:

Medicaid waiver communities on Cleveland's west side

East side communities accepting Ohio Medicaid

Affordable Medicaid options in south suburbs

Near-west Medicaid-approved communities

Southwest suburban Medicaid facilities

Central location with waiver-approved care

Need help navigating Medicaid? Our local advisors provide free guidance →

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.