Uncovering the Hidden Costs of Assisted Living in Greater Cleveland

-

TL;DR: The Bottom Line Up Front

-

The advertised "base rate" for assisted living is just the starting point; it rarely includes hands-on care.

-

"Level-of-care fees" are extra monthly charges for help with daily tasks (like bathing or medications) and are the biggest source of hidden costs.

-

In Ohio, programs like the Medicaid Assisted Living Waiver (AL Waiver) can help pay for care services, but not room and board.

-

Always ask for a complete fee schedule in writing to see all potential charges before signing a contract.

-

One-time community fees ($1,500–$5,000) are common upfront costs you need to budget for.

Who This Guide Helps

This guide is for families in Greater Cleveland (Cuyahoga, Lake, Lorain, Geauga, Medina, and Summit counties) who are comparing senior living options and need to understand the true, total cost. If you're feeling stressed, short on time, and worried about financial surprises, this will give you a clear, calm, and solution-oriented path forward.

Key Takeaways

-

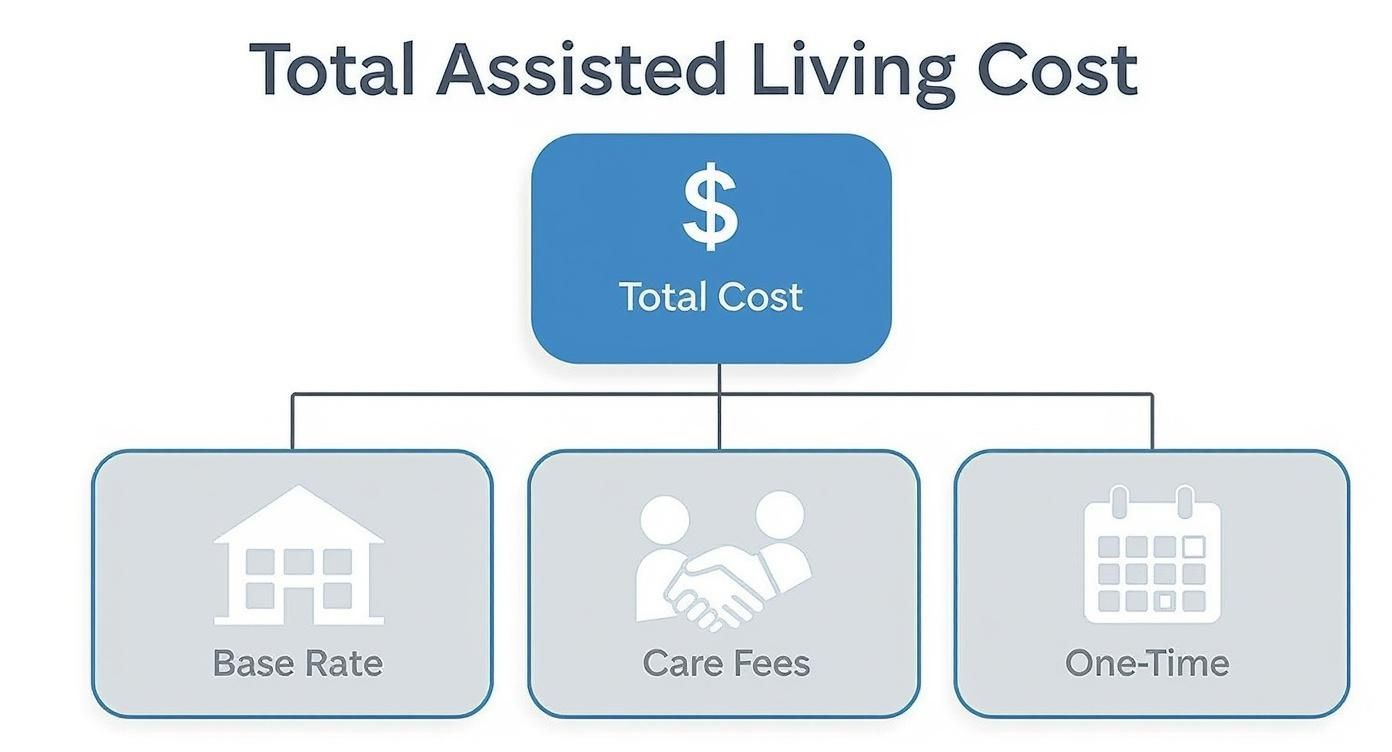

An assisted living bill has three main parts: the base rate (rent/meals), level-of-care fees (hands-on support), and one-time fees (move-in costs).

-

Your final monthly cost will depend on a nursing assessment that determines the level of personal care your loved one needs.

-

You must ask specific questions about how and when care levels are reassessed and what triggers a price increase.

-

Financial assistance is available in Ohio, but eligibility rules are strict. Understanding programs like the AL Waiver upfront is crucial.

Breaking Down the True Cost of Assisted Living in Cleveland

Trying to sort out senior care finances in Northeast Ohio can feel overwhelming. You see an advertised monthly rate, but it's often just the starting price. The final bill frequently includes extra charges for personal care that can add hundreds, or even thousands, to your monthly costs.

This guide is here to cut through the confusion for families across Greater Cleveland. We will look past the sticker price to uncover the real expenses you should anticipate, giving you a straightforward plan to avoid financial surprises.

We’ll start by defining two key terms you'll hear often:

-

Assisted Living (Residential Care Facility): In Ohio, this is the official term for a state-licensed community that provides housing, meals, and personal care support.

-

Medicaid Assisted Living Waiver (AL Waiver): This is a specific Ohio program that helps eligible seniors pay for the care services portion of their assisted living bill. It's important to know it does not cover the cost of room and board.

Why Base Rent Is Only Part of the Story

The advertised "base rent" typically covers the apartment, three meals a day, light housekeeping, utilities, and social activities. What it rarely includes is the hands-on, personal care your family member may need.

What this means for you: The biggest variable in your monthly bill will almost always be the cost of personal care. This is why two people living in identical apartments can pay vastly different amounts each month.

These extra charges, often called level-of-care fees, are tied to a resident's specific health needs, which are determined during an initial assessment by the community's nurse. By understanding how these fees work before you sign a contract, you can ask smarter questions and build a budget that reflects your family’s real needs.

The Three Core Parts of an Assisted Living Bill

Think of an assisted living bill like a utility bill: there's a base monthly price, plus extra charges based on usage. Understanding this structure helps you compare communities accurately and avoid sticker shock. Most communities in the Cleveland area build their pricing around these three parts.

1. The Monthly Base Rate

This is the most straightforward piece. The base rate is essentially the rent. It covers the apartment and the basic perks of living in the community.

You can almost always count on the base rate to include:

-

The Apartment: A private room or apartment.

-

Meals: Usually three meals a day in a community dining room.

-

Utilities: Heat, electricity, water, and sometimes basic cable.

-

Basic Upkeep: Light housekeeping and laundry for towels and linens.

-

Community Life: Access to scheduled activities, classes, and social events.

The key takeaway is that the base rate almost never includes hands-on personal help. That is covered by the next fee.

2. Level-of-Care Fees

This is the biggest source of "hidden" costs. Level-of-care fees are extra monthly charges for the hands-on help a resident needs with their Activities of Daily Living (ADLs)—tasks like bathing, getting dressed, managing medications, or walking safely.

Before move-in, a nurse from the community will conduct a detailed health assessment. Based on that evaluation, your loved one is placed into a specific "care level," each with its own price tag. The more help they need, the higher the care level and the higher the monthly fee.

For a deeper dive into what services are typically bundled, you can explore our guide on what is included in assisted living costs.

What this means for you: Two residents in identical apartments could have very different bills. A mostly independent resident might pay just the base rate. Their neighbor who needs help dressing and medication reminders could easily pay an extra $500 to $2,000+ per month on top of that base rate.

It's critical to ask how often the community reassesses a resident's needs. If your loved one's health changes, they could be moved to a more expensive care level, sometimes with little warning.

3. One-Time Fees

Finally, there are upfront, non-refundable costs. Most communities charge one-time fees before move-in to cover the administrative work of setting up a new resident and preparing the apartment.

This table breaks down common one-time charges in Northeast Ohio. These are illustrative ranges—always confirm the exact costs with each community.

| Fee Category | What It Typically Covers | Common Cost Range (Illustrative) | Questions to Ask |

| :--- | :--- | :--- | :--- |

| Community Fee | Administrative costs, apartment prep (painting, deep cleaning), and onboarding. | $1,500 – $5,000 | Is this fee negotiable or ever waived during a promotion? |

| Move-In Fee | A smaller fee for coordinating the move-in process. Sometimes used instead of a community fee. | $500 – $2,000 | What specific services does this fee cover? |

| Pet Deposit | A one-time fee to cover potential cleaning or damage if a pet is moving in. | $250 – $1,000 | Is this refundable? Are there also monthly pet fees? |

By getting clear answers on these three fees—base rate, level-of-care, and one-time charges—you can build a realistic budget and make a confident choice.

Looking Beyond the Sticker Price: Common Surcharges

It’s easy to focus on the main monthly fee, but smaller, à la carte charges can significantly inflate your bill. These costs often catch families by surprise. A KFF Health News analysis found that unexpected fees are common in long-term care, with charges like $12 for a daily blood pressure check or $50 for a single injection. You can read the full analysis of long-term care fees on kffhealthnews.org.

This flowchart shows how the total cost is built from these different pieces.

Common Add-On Services and Their Costs

Every community sets its own fee schedule. During your tour, it is essential to ask for a complete list of these charges.

Here are common surcharges you may find in Northeast Ohio:

-

Medication Management: This is rarely included in the base rate. Costs are often tiered based on complexity, from simple reminders to administering injections.

-

Transportation: Group outings are usually included, but personal trips are not. Expect to pay a per-mile or flat-rate fee for individual rides to a doctor in Cleveland or a specialist in Lorain.

-

Incontinence Care: This involves two costs: the supplies (pads, briefs) and the staff time to provide assistance.

-

Specialized Diets: If your loved one needs something beyond the standard menu, like puréed meals, there may be a surcharge.

What this means for you: Even small daily charges add up. A $10 daily fee for a wellness check is another $300 on your monthly bill. Always ask for a detailed fee schedule to estimate these costs accurately.

How Ohio Families Can Pay for Assisted Living

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/7BPr9XKmgWU" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Figuring out how to pay for care is a concern every family faces. For most in Northeast Ohio, the solution is a combination of funding sources, like long-term care insurance, personal savings, and government benefits.

Using Long-Term Care Insurance

A Long-Term Care (LTC) Insurance policy can be a game-changer. These policies are designed to cover services like assisted living once a person needs help with a certain number of ADLs.

Key terms to understand in your policy:

-

Elimination Period: The number of days (often 30, 60, or 90) you must pay out-of-pocket before the policy begins to pay.

-

Daily or Monthly Benefit: The maximum amount your policy will pay per day or month. You are responsible for any costs above this limit.

VA Aid & Attendance for Veterans

Veterans and their surviving spouses may qualify for Aid & Attendance, a tax-free payment added to a monthly VA pension for those who need help with daily activities. Eligibility requires meeting specific military service, income, and asset rules, as well as having a documented medical need for care. The application process can be slow, so it is wise to start early.

The Ohio Medicaid Assisted Living Waiver

For many Ohioans, the Medicaid Assisted Living Waiver (AL Waiver) is a vital resource. This state program helps eligible seniors pay for the care services they receive in assisted living.

What this means for you: In Ohio, the AL Waiver does not cover room and board. The resident is responsible for their monthly rent and meals, typically paid with their Social Security or other income. The waiver pays the community directly for hands-on care.

Approval depends on both medical and financial need. An individual must require an "intermediate level of care" and meet strict income and asset limits set by Ohio Medicaid.

Example: Cuyahoga County family using the AL Waiver

A family in Cuyahoga County is considering a community for their mother that costs $5,200 per month. Her only income is her $1,900 monthly Social Security benefit, making the community seem unaffordable.

After she is approved for the AL Waiver, the financial picture changes. The waiver pays the community for her care services. Her Social Security income is then used to cover her room and board costs. An option that once seemed out of reach becomes manageable.

To learn more about the requirements and application process, read our guide on how the Medicaid Assisted Living Waiver works in Ohio.

These financial programs are critical. According to AARP, hidden fees and variable care costs can make budgeting difficult, reinforcing the need to understand all potential expenses. You can learn more about the unexpected costs of assisted living on aarp.org.

Your Financial Due-Diligence Checklist

This checklist is designed for you to use on tours and in meetings with staff at any Northeast Ohio community. It will help you get the complete financial picture needed for a true apples-to-apples comparison.

Use this guide to keep your conversations focused on the financial details that matter most.

Financial Due Diligence Checklist for Assisted Living

| Checklist Item | Why It's Important | Notes/Community Response |

| :--- | :--- | :--- |

| Request the Complete Fee Schedule | The marketing brochure gives highlights; the fee schedule tells the whole story, listing every potential charge. | |

| Get a Sample Residency Agreement | This is the legal contract. Review it without pressure to understand rules, resident rights, and the fine print on rate increases. | |

| Clarify Move-Out Policies | Understand the required notice period and any potential fees to avoid costly surprises during a stressful time. | |

| Ask About Care Assessment Frequency | Is it quarterly, or only when a health change occurs? This shows how proactively they adjust care and billing. | |

| Pinpoint Care-Level Triggers | Ask for specifics: What exactly causes a move to a higher, more expensive care level? Get concrete examples. | |

| Inquire About Annual Rate Increases | Most communities raise rates 3-6% annually. Ask for their rate-increase history for the past three years to check for consistency. | |

| Get a Detailed Care-Package Breakdown | Ask to see what's included in each level-of-care package to understand the value at every price point. | |

Taking time to get these details in writing allows you to go home and make a decision based on facts, not just feelings. For more guidance, review our comprehensive list of questions to ask assisted living facilities before your next tour.

What to Do Next

Feeling overwhelmed is normal, but you can take control by focusing on these concrete next steps:

-

Use the Checklist on Your Next Tour: Print the checklist above and take it with you. Do not leave without getting clear answers to each question. Ask for the documents (fee schedule, sample agreement) to take home and review.

-

Estimate Your Total Monthly Cost: Use the information you gather to create a simple formula: Base Rate + Estimated Level-of-Care Fee + Common Add-Ons (like medication management) = Total Estimated Monthly Cost. Do this for each community to compare them accurately.

-

Explore Financial Assistance Options: If you think you might need help, contact your local Area Agency on Aging to learn about the AL Waiver pre-screening process. For veterans, start the VA Aid & Attendance application process as soon as possible.

-

Schedule a Follow-Up Call: After your tour, schedule a brief call with the community director to ask any follow-up questions that came up after reviewing the documents at home.

Frequently Asked Questions About Senior Living Costs

It’s normal to still have questions. Here are clear, straightforward answers to what we hear most from families in Northeast Ohio.

How often do assisted living rates increase?

You should expect rates to increase annually to keep up with inflation and rising operational costs. In Ohio, you can generally plan for the base monthly rate to go up by about 3% to 6% each year. State law requires communities to provide residents with written notice, typically 30 to 60 days in advance, before any price change takes effect.

What this means for you: When you tour a community in Cuyahoga or Lorain County, ask for their rate increase history over the past three years. A facility with a track record of small, predictable increases is easier to budget for than one with sudden jumps.

What happens if we run out of money?

This is a common fear. The most important thing is to plan ahead. If a resident’s private funds are depleted, they may become eligible for Ohio's Medicaid Assisted Living Waiver (AL Waiver). However, not all communities accept the AL Waiver. If your loved one is in a facility that doesn’t participate, you would need to find one that does and arrange a move. It is critical to ask about a community's Medicaid policy before signing any contract. Consulting with an elder law attorney can help you create a long-term financial plan.

Can assisted living costs be deducted on taxes?

In many cases, yes. The IRS allows you to deduct medical expenses, and assisted living costs can qualify if the primary reason for being there is to receive medical care. A resident must be certified by a licensed health care practitioner as "chronically ill," meaning they are unable to perform at least two Activities of Daily Living (ADLs)—like bathing or dressing—without help.

-

If medical care is the primary reason: You may be able to deduct the entire cost, including room and board.

-

If the move is for non-medical reasons: You can still deduct the portion of the fees that goes directly toward medical or nursing care.

You must itemize these deductions on your tax return, and you can only deduct the amount of medical expenses that exceeds 7.5% of your adjusted gross income (AGI). Keep detailed records of all payments.

Disclaimer: This article is informational and not legal, financial, or medical advice. Please consult with qualified professionals for guidance on your family’s specific situation.

Planning for senior care in Northeast Ohio can feel complicated, but you don't have to do it alone. The local experts at Guide for Seniors can help your family understand the costs, compare communities, and find the right fit for your loved one's needs and budget. Get your free, personalized recommendations today.

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.