Navigating the Cost of Senior Living in Cleveland, Ohio

Trying to understand the cost of senior living in Northeast Ohio can feel overwhelming, especially when you’re stressed and short on time. This guide is here to provide a clear, calm financial roadmap for your family’s journey in the Greater Cleveland area. We want to help you make a smart, informed choice without the pressure.

-

TL;DR: Key Points at a Glance

-

Senior living bills have two main parts: a base rate (rent, meals, activities) and separate level-of-care fees for hands-on help.

-

In Ohio, programs like the Medicaid Assisted Living Waiver (AL Waiver) can help pay for care, but not room and board.

-

A simple budget formula is: (Monthly Income + Monthly Asset Drawdown) = Your Amount Available for Care.

-

Always ask communities for a written breakdown of their base rates and care fees to make a true apples-to-apples comparison.

Who this helps

This guide is for families in Cuyahoga, Lake, Lorain, Geauga, Medina, and Summit counties who are:

-

Trying to figure out the best care options for an aging parent or relative.

-

Comparing assisted living, memory care, and nursing home costs.

-

Feeling stressed by how complicated senior living prices seem.

-

Looking for straightforward, local information that applies to Northeast Ohio.

Key takeaways

By the end of this guide, you will understand:

-

How senior living communities structure their pricing.

-

Ohio-specific programs that can help make care more affordable.

-

A practical way to create a realistic monthly budget for care.

-

Clear next steps to take on your search.

This article is informational and not legal, financial, or medical advice. Please consult with licensed professionals for guidance on your specific situation.

Decoding Senior Living Prices in the Cleveland Area

When a senior living community gives you a pricing sheet, it can feel confusing. But the total monthly cost almost always breaks down into two main parts. Understanding this structure is the key to creating a realistic budget.

Think of it like this: your monthly bill has a fixed part (like rent) and a variable part (for the specific care you receive). This model ensures you only pay for the support you actually need.

Alt text: A simple flowchart shows that the total cost of senior living is the sum of two parts: the Base Rate (covering housing, meals, and amenities) and Level-of-Care Fees (covering personal assistance and healthcare support).

The Two Parts of Your Monthly Bill

Almost all communities separate their pricing into a base rate and care fees.

1. Base Rate (The "Rent")

This is the foundational cost everyone pays. It covers the apartment and all the core services and amenities that make life easier and more social.

The base rate usually includes:

-

Housing: A private apartment or suite.

-

Meals: Three daily meals served in a dining room, plus snacks.

-

Utilities: Electricity, water, heat, and trash removal are typically bundled.

-

Maintenance: No more yard work, snow shoveling, or home repairs.

-

Activities: A calendar of social events, wellness programs, and group outings.

The base rate varies based on apartment size, location, and the level of amenities offered.

2. Level-of-Care Fees (The "Care")

This part of the bill is personalized. Level-of-care fees are charges for any hands-on, personal help a resident needs. Before moving in, a community nurse conducts an assessment to determine the right level of support.

These fees cover services like:

-

Help with Activities of Daily Living (ADLs)—things like bathing, dressing, and grooming.

-

Medication management to ensure prescriptions are taken safely and on time.

-

Specialized support for residents with dementia in a memory care setting.

-

Mobility assistance, such as help getting to and from the dining room.

Communities often group these services into tiers or levels, each with a set monthly fee. A very independent person might have a small care fee, while someone needing significant daily support will have a higher one.

What this means for you: When you tour a community in Cuyahoga, Lake, or Lorain county, ask for a clear, written breakdown of their base rates and their level-of-care fee structure. This is the only way to get a true estimate of the final monthly cost.

Estimated Monthly Senior Living Costs in Northeast Ohio

This table shows typical starting monthly price ranges for different senior living options in the Greater Cleveland area as of early 2025. Prices vary by community, apartment size, and level of care needed.

| Type of Care | Typical Monthly Base Rate Range | Common Services Included |

| :--- | :--- | :--- |

| Independent Living | $2,800 – $5,000+ | Housing, meals, utilities, activities, maintenance, transportation. |

| Assisted Living | $4,500 – $7,500+ | All of the above, plus help with ADLs, medication management. |

| Memory Care | $6,000 – $9,000+ | All of the above, plus specialized dementia care, secured environment. |

| Skilled Nursing | $9,500 – $12,000+ | 24/7 medical care, rehabilitation services, post-hospital support. |

These numbers are a starting point and show how costs align with the level of care provided. To learn more, check out our guide on what is included in assisted living costs.

How to Pay for Senior Living in Ohio

Once you have an estimated monthly cost, the next question is, "How will we pay for this?" For most families in Northeast Ohio, the answer is a combination of resources. Let's walk through the most common ways to fund senior living.

Alt text: Four icons representing common payment options for senior living: a wallet for private pay, a shield for long-term care insurance, a military medal for VA benefits, and a government building for Medicaid.

Private Pay Using Personal Assets

The most common method is private pay, which means using personal financial resources.

These resources can include:

-

Savings and Investments: Money from checking/savings accounts, stocks, and bonds.

-

Retirement Income: Social Security, pensions, and 401(k) or IRA distributions.

-

Sale of a Home: The equity from a family home is often the primary source of funding.

-

Annuities or Trusts: Financial tools set up to provide a reliable income stream.

Private pay offers the most freedom to choose any community that fits your budget and care needs.

Long-Term Care Insurance Policies

If your loved one has a long-term care (LTC) insurance policy, it's designed to cover services like assisted living. To activate the policy, a doctor typically must certify that the person needs help with at least two Activities of Daily Living (ADLs).

What this means for you: Review the policy for the daily benefit amount, the elimination period (a waiting period before payments begin), and the total lifetime maximum. Contact the insurance company early to start the claims process.

Benefits for Veterans and Spouses

The U.S. Department of Veterans Affairs (VA) offers a benefit called Aid and Attendance for wartime veterans and their surviving spouses. It can provide a significant monthly payment to help cover assisted living costs.

Eligibility basics include:

-

Military Service: The veteran served at least 90 days of active duty, with at least one day during a period of war.

-

Medical Need: The applicant requires help with daily activities.

-

Financial Limits: The VA has income and asset thresholds, though medical expenses can be deducted.

Contact your local County Veterans Service Office for help with the application.

Ohio's Medicaid Assisted Living Waiver

For seniors with limited income and assets, the Medicaid Assisted Living Waiver (AL Waiver) can be a lifeline. In Ohio, this program helps pay for the care services portion of the bill at an approved Assisted Living (Residential Care Facility). The resident typically still pays for room and board from their own income, like Social Security.

-

Eligibility: An applicant must meet Ohio Medicaid's financial limits and be assessed as needing a nursing-home level of care.

-

How to Apply: The first step is to contact your local Area Agency on Aging (AAA) to schedule a free assessment.

Example: A Cuyahoga County family is helping their father apply for the AL Waiver. His income is below the limit, and the AAA assessment confirms he needs daily assistance. Once approved, the waiver pays the assisted living community directly for his care services. The family uses his Social Security check to cover his monthly room and board fee.

Learn more in our guide to the Medicaid Assisted Living Waiver in Ohio.

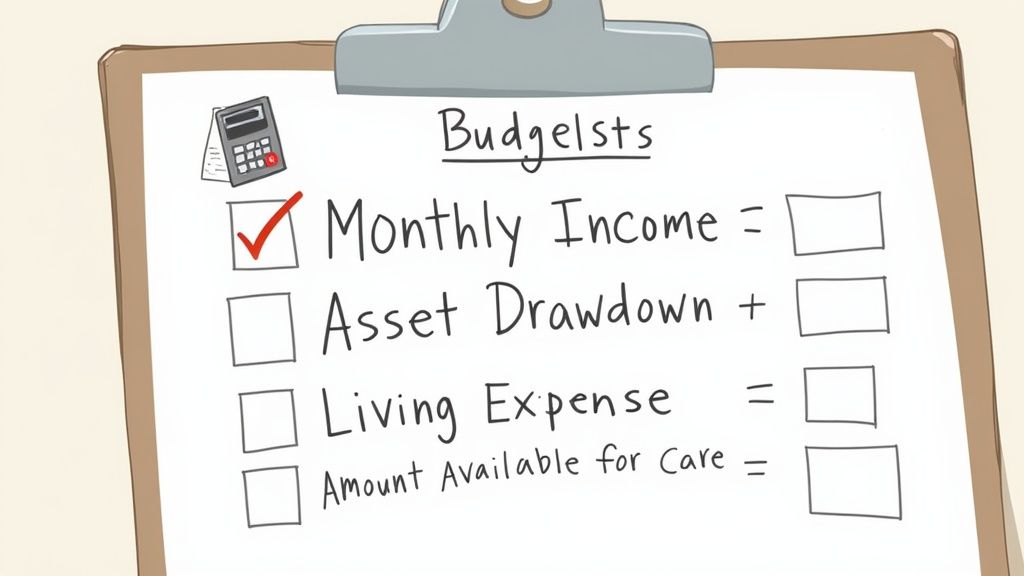

Creating a Realistic Senior Care Budget

Talking about money can be stressful, but creating a clear budget will empower you to move forward with confidence. The goal is to figure out what you can comfortably afford each month.

Alt text: A clipboard with a financial checklist titled 'Budgeting,' listing categories for income, assets, and expenses to help plan for senior living costs.

The Simple Formula for Affordability

Use this straightforward formula to find your monthly budget:

(Monthly Income + Monthly Asset Drawdown) = Amount Available for Care

-

Monthly Income: Consistent money coming in (Social Security, pensions).

-

Monthly Asset Drawdown: The amount you plan to pull from savings or investments each month.

-

Amount Available for Care: Your realistic monthly budget for senior living.

Your Senior Living Budgeting Checklist

Use this checklist to gather the information needed to calculate your budget. Solid estimates are fine to start.

| Financial Category | Documents to Look For | Estimated Monthly Amount |

| :--- | :--- | :--- |

| Income | Social Security statements, pension stubs, annuity statements | $____________ |

| Assets | Bank statements (savings, checking), investment account summaries | $____________ |

| Insurance/Benefits | Long-Term Care Insurance policy, VA benefit letters | $____________ |

| Home Equity | Recent property tax bill or home appraisal | $____________ |

Having these numbers will make your conversations with financial advisors and senior living communities much more productive.

For those considering dementia care, you can learn more about how much memory care costs and adjust your budget accordingly.

Why Is Senior Living So Expensive?

It’s normal to feel sticker shock when you first see the monthly cost. The price reflects some very real economic factors, primarily driven by a nationwide surge in demand and the rising complexity of care.

A Historic Surge in Demand

The Baby Boomer generation is now entering their senior years, creating an unprecedented need for senior living options. According to a KPMG analysis, the global senior living market is projected to grow significantly as this demographic shift continues. This high demand for a limited supply of specialized housing and professional caregivers puts upward pressure on prices. You can explore the global senior living landscape with this KPMG analysis.

What this means for you: The prices you see are a direct result of this demographic shift. Understanding this helps frame the cost not as an arbitrary number, but as a reflection of the market for specialized housing and professional care.

Care Needs Are Becoming More Complex

The type of care needed is also becoming more intensive, especially for memory-related conditions like Alzheimer's. Providing high-quality memory care is more expensive to operate because it requires:

-

Higher Staff-to-Resident Ratios: More staff are needed to ensure residents are safe and engaged.

-

Specialized Training: Caregivers receive training in dementia care, de-escalation, and creating a supportive environment.

-

Purpose-Built Environments: Communities invest in secure layouts and therapeutic programs designed for residents with cognitive decline.

These essential enhancements increase a community's operational costs, which directly impacts the overall cost of senior living.

What to do next

Knowing the numbers is one thing, but taking action is what makes a difference. Here is a manageable plan to guide you from here.

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/cyttV78GVmQ" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>-

Gather Your Financial Documents. Use the checklist in the budget section to collect Social Security statements, bank summaries, and insurance policies. This turns vague worries into a concrete financial picture.

-

Contact Your Local Area Agency on Aging (AAA). This is a critical step, especially if the Ohio AL Waiver is a possibility. In Ohio, the AAA is the starting point for a free needs assessment. Find your local office on the Ohio Department of Aging's website.

-

Schedule at Least Three Community Tours. You have to visit in person to get a true feel for a community. During your tour, ask for a detailed, written breakdown of their costs, including base rates and all level-of-care fees.

-

Check Inspection Reports. For assisted living communities (officially called Residential Care Facilities), look up their latest inspection report on the Ohio Department of Health website. For Skilled Nursing Facilities, check their ratings on the federal CMS Care Compare site.

Keep These Ohio Resources Handy

-

Ohio Long-Term Care Ombudsman: Your advocate for residents' rights. If you have an issue with care, they are the ones to call. You can report a concern or talk to the Ombudsman.

-

Guide for Seniors: Our local advisors can help you compare communities, understand pricing, and schedule tours at no cost to your family.

Frequently Asked Questions (FAQ)

Here are answers to some of the most common questions we hear from families in Northeast Ohio.

Does Medicare Pay for Assisted Living in Ohio?

No. This is the most common misconception. Original Medicare (Part A and Part B) does not pay for long-term custodial care, which includes the room, board, and personal assistance provided in assisted living. Medicare is health insurance for doctor visits, hospital stays, and short-term skilled nursing after a qualifying hospital stay.

What Happens If My Parent Runs Out of Money in Assisted Living?

This is a valid concern. If a resident's savings are depleted, the most common solution is to apply for Ohio's Medicaid Assisted Living Waiver (AL Waiver). However, not all communities accept the waiver.

It is critical to ask communities this question upfront: "Do you accept the Medicaid AL Waiver if a resident spends down their assets?" Getting a clear answer from the beginning can prevent a stressful and disruptive move later on.

Are Senior Living Costs Tax-Deductible?

Some costs may be. The IRS allows you to deduct medical expenses, which can include the cost of care in an assisted living community if the primary reason for being there is to receive medical care. You generally cannot deduct the "rent" portion (room and board) if the reason for the move was personal convenience. Because tax laws are complex, we recommend consulting a qualified tax advisor to review your specific situation.

Figuring out the finances of senior living can be challenging, but you don't have to do it alone. Our local advisors at Guide for Seniors offer free, one-on-one support to help families in Northeast Ohio find the right fit. Let us help you compare the real costs and find a solution that works for your budget and your family.

You can get started by visiting us at https://www.guideforseniors.com.

Need Help Finding Senior Living in Greater Cleveland?

Our Greater Cleveland local advisors can provide personalized recommendations, schedule tours, and answer all your questions—completely free.